Sidechain Cost Calculator

Main Chain vs Sidechain Comparison

See the real cost differences between Ethereum main chain and Polygon sidechain for your transaction volume.

Ethereum Main Chain

Polygon Sidechain

That's 0% of your Ethereum costs saved!

Security Note

While sidechains reduce costs, they don't inherit the same security as the main chain. Always check bridge security - Polygon (POSA) has 100 validators while Ethereum has over 800,000 stakers. For transactions over $10,000, consider keeping funds on main chain.

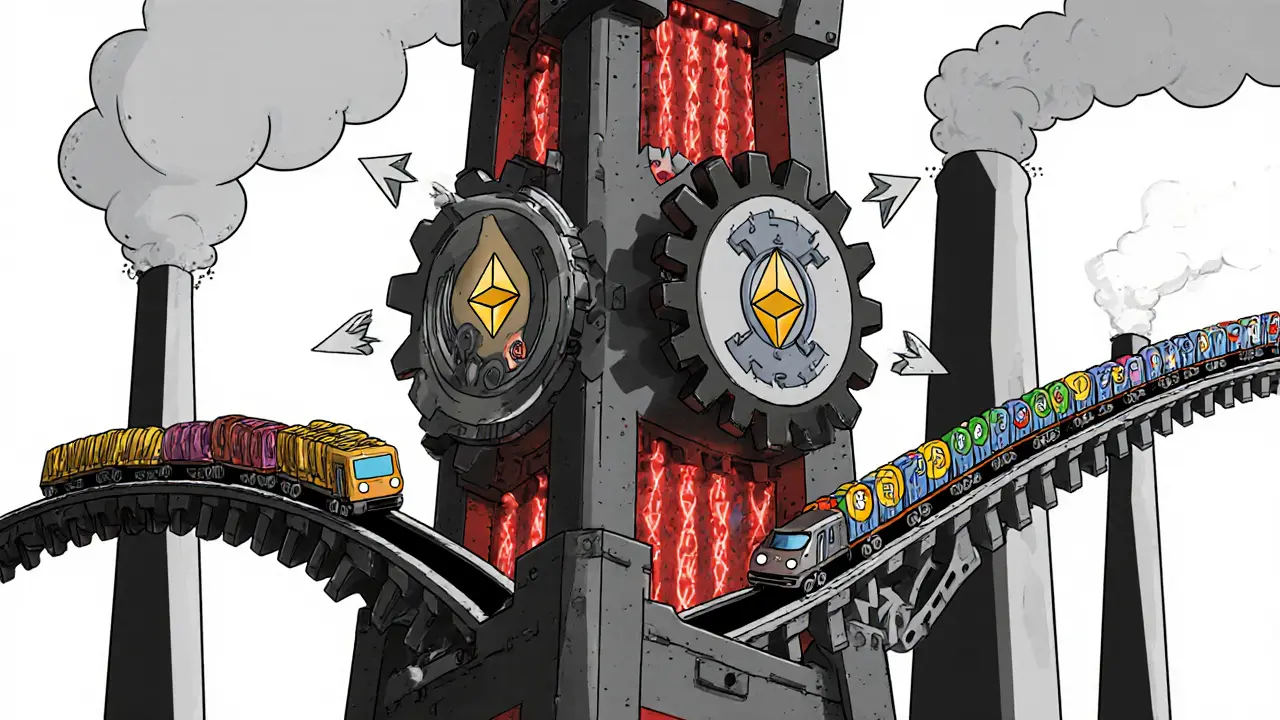

Most people think of blockchains as single, isolated networks - Bitcoin on one side, Ethereum on the other. But that’s not how modern blockchain systems actually work. Behind the scenes, dozens of blockchains are talking to each other, moving value back and forth without ever leaving the safety net of the original chain. This isn’t magic. It’s called a sidechain, and the way it connects to the main blockchain is what makes scaling possible.

What Exactly Is a Sidechain?

A sidechain is its own blockchain, running separately from the main one - but with a direct, secure link. It doesn’t replace the main chain. Instead, it acts like an offshoot, handling tasks that would otherwise clog up the main network. Think of it like a side road to a highway. The main highway (Ethereum, Bitcoin) stays fast and secure for high-value traffic. The side road (Polygon, Ronin) takes the heavy, low-value traffic - like game transactions, small payments, or NFT trades - so the main road doesn’t get jammed. The idea wasn’t just dreamed up in a lab. It was written down in a 2014 paper by a group of blockchain engineers from Blockstream and other teams. They called it a "pegged sidechain," and they meant it literally: assets get locked on the main chain and "pegged" to an equivalent amount on the sidechain. That’s the core of how everything works.The Two-Way Peg: The Heart of the Connection

This is the technical engine that makes sidechains possible. It’s called a two-way peg because assets can move both ways - from main chain to sidechain, and back again. Here’s how it works in practice:- You want to send 1 ETH from Ethereum to Polygon.

- You send it to a smart contract on Ethereum - a special address that doesn’t belong to any person, just code.

- Ethereum’s network confirms the transaction. It waits for about 25-50 minutes (100-200 blocks) to make sure it’s final and can’t be reversed.

- Once confirmed, a signal is sent to Polygon’s network.

- Polygon mints 1 wrapped ETH (wETH) on its chain - this isn’t real ETH, but a token that represents it.

- You now have wETH on Polygon. You can use it to buy NFTs, swap tokens, or play games - all for pennies in gas fees.

How the Bridge Actually Works

The connection between the chains isn’t a direct wire. It’s a bridge - and bridges come in different flavors. There are three main types:- Federated bridges: A group of trusted nodes (like 9 companies or teams) vote to confirm transfers. Fast, but if even one node is hacked, the whole bridge is at risk. Ronin Network used this model - and got hacked for $625 million in 2022.

- Proof-of-Stake bridges: Validators lock up their own crypto (like MATIC tokens) as collateral. If they cheat, they lose their stake. Polygon uses this. It’s more secure than federated because there’s financial skin in the game.

- Trustless bridges: These rely purely on cryptography - no trusted parties. They’re the hardest to build but offer the highest security. Most are still experimental.

Why This Matters: Speed, Cost, and Scale

Ethereum can process about 30 transactions per second. Each one costs around $1.20 on average. On Polygon, you can do 7,200 transactions per second - and each one costs $0.0001. That’s not a small difference. It’s a game-changer. That’s why gaming companies like Immutable X and Decentraland moved to sidechains. Before Polygon, a single land sale in Decentraland cost $45 in gas. After switching, it dropped to $0.03. Daily active users jumped from 2,300 to 12,000 in just months. Same goes for NFTs. Gods Unchained, a trading card game, handles 9,000 NFT trades per second on Immutable X. On Ethereum, that would be impossible. The network would freeze.The Hidden Risk: Bridge Hacks

There’s a dark side. While sidechains make things faster and cheaper, they also create new attack surfaces - and most of them happen at the bridge. Between 2020 and 2023, 65% of all blockchain hacks targeted bridge systems. Total losses? Over $2.8 billion. The Ronin hack was the biggest. Nine validators were compromised. Hackers signed fake transactions and walked away with $625 million in ETH and USDC. The problem? Trust. Federated bridges rely on a small group of operators. If they’re compromised - or bribed - the whole system collapses. Even proof-of-stake bridges aren’t perfect. Polygon has 100 validators. Ethereum has over 800,000. That’s a massive security gap. Vitalik Buterin put it bluntly: sidechains are useful, but they’re not as secure as the main chain. They’re a trade-off - speed and cost for reduced security.Who Should Use Sidechains - And Who Shouldn’t

Not everything belongs on a sidechain. Great for:- Games and NFT marketplaces

- Microtransactions under $100

- Apps that need fast confirmations (under 5 seconds)

- High-volume, low-value transfers

- Large institutional transfers (millions in ETH or stablecoins)

- Long-term savings or custody

- Any system where losing funds means real-world damage

What’s Next? The Future of Sidechain Connections

The tech is evolving fast. Polygon’s new Supernet lets anyone launch their own custom sidechain with a dedicated bridge - no need to share validators with others. That could mean thousands of specialized sidechains in the next few years. Ethereum’s upcoming Proto-Danksharding upgrade (coming in early 2024) will slash bridge costs by 90% by making data cheaper to store. That could make sidechains even more efficient. Then there’s Chainlink’s CCIP, launched in October 2023. It uses decentralized oracles - not validators - to verify cross-chain messages. No single point of failure. No trusted group. It’s still early, but it’s the first real attempt at a trust-minimized bridge that doesn’t rely on staked tokens or federated nodes. The goal? A future where sidechains don’t just offload traffic - they share security with the main chain. Modular blockchains. Shared consensus. That’s where the industry is heading.What Developers Need to Know

If you’re building on a sidechain:- Always test withdrawal delays. Some bridges take 12-48 hours. Don’t assume instant.

- Use the official bridge. Third-party bridges have been hacked repeatedly.

- Check the validator count. More validators = more security.

- Implement circuit breakers in your app. If the bridge goes down, pause withdrawals until it’s fixed.

Final Thoughts: A Tool, Not a Replacement

Sidechains aren’t the future of blockchain. They’re a tool - a smart, necessary one. They solve real problems: congestion, cost, and speed. But they don’t replace the main chain. They depend on it. The main chain is the anchor. The sidechain is the sail. Without the anchor, you drift. Without the sail, you can’t move fast. As long as users understand the trade-offs - speed for security - sidechains will keep growing. But the moment people treat them like they’re as safe as Ethereum or Bitcoin, someone will lose everything.Can I send Bitcoin to a sidechain?

Yes, but only through specific sidechains built for Bitcoin, like Liquid Network or Rootstock (RSK). These use a two-way peg similar to Ethereum sidechains. Bitcoin itself doesn’t natively support sidechains, so the connection relies on trusted custodians or federated models. Always use official bridges - third-party wrappers are risky.

Are sidechains decentralized?

It depends. Proof-of-stake sidechains like Polygon are more decentralized than federated ones like Ronin. But even Polygon has only 100 validators - compared to Ethereum’s 800,000+ stakers. So while they’re decentralized in theory, they’re not as decentralized as the main chain. True decentralization means thousands of independent participants. Most sidechains still rely on a few dozen.

Why not just scale the main chain instead?

Scaling the main chain is hard. Ethereum is trying with rollups and sharding, but those take years to deploy and require massive upgrades. Sidechains offer immediate scaling without changing the core protocol. They’re a pragmatic workaround - not a perfect solution. Think of them as temporary relief while the main chain gets upgraded.

How long does it take to move assets back to the main chain?

On Polygon, withdrawals usually take 2-3 hours. But during high congestion, they can take up to 24 hours. Ethereum’s Optimism rollup (not a sidechain) takes 7 days for withdrawals - that’s intentional for security. Sidechains prioritize speed, so they use shorter time locks. Always plan ahead if you need to move funds back.

Is my money safe on a sidechain?

Your assets are only as safe as the bridge. If the bridge is hacked, you lose everything - even if the main chain is untouched. Sidechains don’t inherit the main chain’s security. They rely on their own validator set. Always check the bridge’s security model. Avoid bridges with fewer than 50 validators. Stick to well-audited, official bridges like Polygon’s or Arbitrum’s.

Comments

Jess Bothun-Berg

Sidechains? Meh. I’ve seen this movie before-remember the 2017 altcoin craze? Everyone said ‘this time it’s different.’ Now we got $2.8B gone, Ronin’s still a punchline, and people act like Polygon’s a bank. I’m just here for the memes, not the ‘security models.’

November 28, 2025 at 20:33

Steve Savage

Honestly? This is the most balanced breakdown I’ve read in years. You’re right-it’s not magic, it’s trade-offs. Like choosing between a sports car and a station wagon. One’s fast, cheap, and fun for daily errands. The other’s slower, pricier, but you’d trust it with your family and heirlooms. Sidechains are the sports car. Don’t park your life savings in it. But for gaming, NFTs, microtransactions? Perfect. The real win is making crypto usable for normal humans, not just degens with 17 wallets.

November 29, 2025 at 01:27

Joe B.

Let’s get real for a sec-this whole ‘trustless bridge’ fantasy is just VC-speak for ‘we haven’t figured out how to make it secure yet.’ The fact that even Polygon’s got 100 validators-compared to Ethereum’s 800K-should terrify anyone who thinks this is ‘decentralized.’ And don’t even get me started on CCIP. Chainlink’s oracles? They’re just another centralized oracle farm with a fancy whitepaper. 😒 The math doesn’t lie: fewer validators = higher attack surface. And we’ve seen the math fail. 65% of all hacks? That’s not a bug, it’s the design. They built a highway that only works if 67 out of 100 truckers don’t get bribed. That’s not innovation. That’s gambling with your ETH. And the worst part? People are already using this to buy NFTs of cartoon apes. We’re not building the future. We’re building a casino with a blockchain logo.

November 29, 2025 at 02:40

Rod Filoteo

Y’all think this is about tech? Nah. This is a controlled demolition. Big banks and governments want you to think crypto is decentralized-but they’re the ones running the validators behind the scenes. Polygon? Ronin? All of it’s puppet strings. They let you play with fake money on a sidechain so you don’t notice the real money’s still locked in the Fed’s system. And when the bridge gets hacked? Boom. You lose everything. But the real winners? The ones who sold before the hack. Always the insiders. Always. I’ve seen the patterns. This isn’t Web3. It’s Web2 with more acronyms. And don’t even get me started on Vitalik… he’s either naive or complicit. Either way… 🤫

November 29, 2025 at 06:38

Layla Hu

Thanks for writing this. I’ve been trying to explain sidechains to my dad, and this is the clearest thing I’ve found. I’m keeping it on file.

November 30, 2025 at 01:12

Nora Colombie

Why are Americans so obsessed with ‘scaling’ like it’s some kind of competition? We don’t need sidechains-we need better regulation. In Europe, they don’t let people gamble with crypto like this. If you want to move $10K, you use a bank. Simple. No 100 validators, no Merkle proofs, no ‘trustless’ nonsense. Just KYC, compliance, and actual accountability. America’s obsession with ‘decentralization’ is just a cover for reckless risk-taking. We’re not building the future-we’re building a financial disaster waiting to happen. And now you’re teaching people how to lose their life savings faster? Shameful.

November 30, 2025 at 09:50