Iran Crypto Mining Impact Calculator

Estimate how many mining rigs would consume electricity and impact Iranian households. Based on data from the article about IRGC-controlled operations.

Energy Consumption

Human Impact

IRGC Mining Power Use: 0 MW (175 MW in Rafsanjan example)

This power could keep hospitals, schools, and factories running during blackouts.

Civilian Impact: 0 hours (8-12 hour blackouts in winter)

Estimated blackout duration based on article data.

When Iran’s power grids fail and homes go dark for days, the lights in certain secret facilities stay on-bright, constant, and running nonstop. These aren’t hospitals or military command centers. They’re crypto mining farms, owned and operated by the Islamic Revolutionary Guard Corps (IRGC), siphoning off enough electricity to power entire cities while ordinary Iranians struggle to keep their refrigerators cold or charge their phones.

How Crypto Mining Became a State Weapon

Iran’s cryptocurrency mining boom didn’t start as a tech trend. It began as a survival tactic. After U.S. and European sanctions cut off Iran’s access to global banking systems in the 2010s, the regime needed a way to move money without banks. Bitcoin, with its decentralized network and minimal oversight, became the perfect tool. But instead of letting ordinary citizens mine it, the IRGC took control. By 2020, the IRGC had already built massive mining operations, mostly in remote provinces like Kerman and Sistan-Baluchestan. These weren’t backyard setups. They were industrial-scale farms with tens of thousands of ASIC miners-specialized computers designed to solve complex math problems and earn Bitcoin. One facility in Rafsanjan alone consumed 175 megawatts of power. That’s more than some small countries use. The IRGC didn’t just buy these machines. They got them cheap, often through Chinese suppliers who ignored international sanctions. Then they connected them to power lines that were never meant for mining. Electricity in Iran is heavily subsidized, but only civilians and licensed businesses are supposed to get it. The IRGC? They bypassed the rules entirely.The Two-Tiered System: Who Gets Power, Who Doesn’t

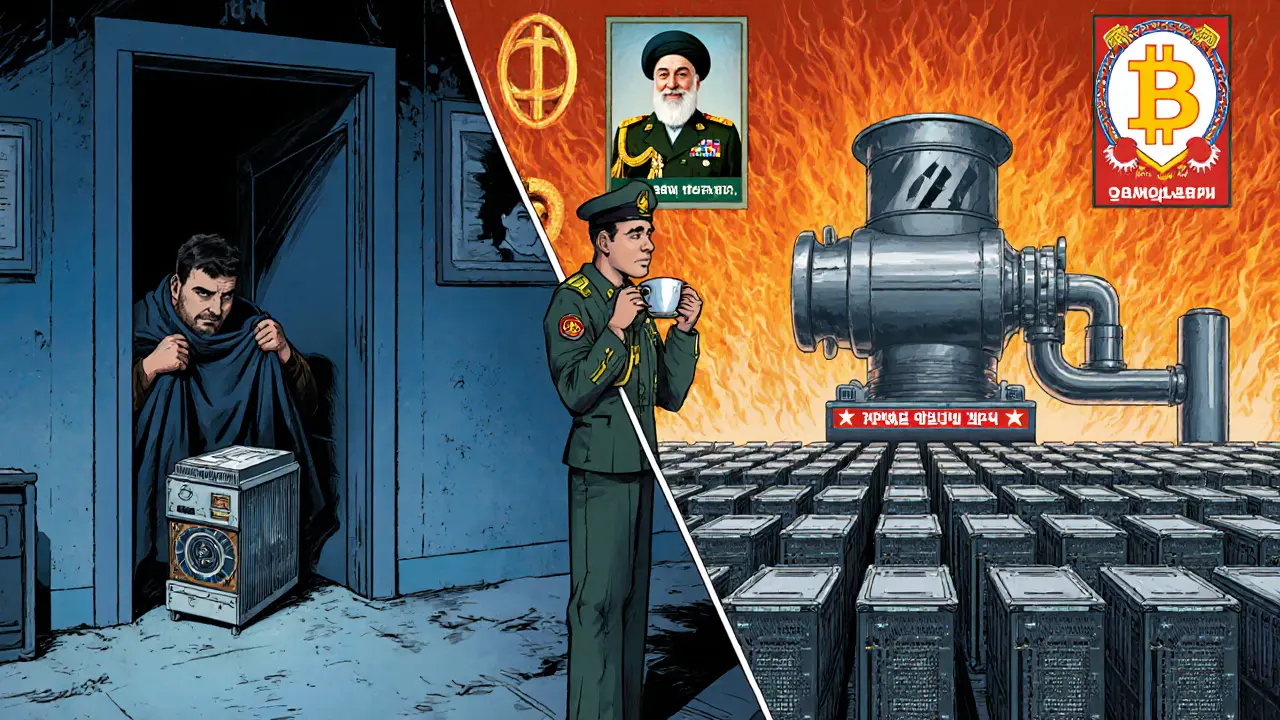

In Iran, there are two kinds of crypto miners: the ones who pay and the ones who don’t. Private miners must register with the Ministry of Industry, Mines, and Trade. They pay high electricity rates-sometimes more than $0.10 per kilowatt-hour-and are forced to sell their Bitcoin directly to the Central Bank of Iran at a fixed price. Most can’t make a profit. Many shut down. Meanwhile, IRGC-linked operations operate with zero oversight. They don’t pay bills. They don’t need licenses. They don’t even need to report their earnings. Some of these operations are hidden inside military bases. Others are disguised as religious foundations, like Astan Quds Razavi, a massive charitable trust controlled by Supreme Leader Ali Khamenei. These entities don’t just mine crypto-they own the power plants that feed them. In 2022, Iran’s parliament quietly passed a law letting the military build its own power grids. That meant the IRGC could now divert electricity meant for Tehran’s hospitals and factories straight into their mining farms. The result? Cities like Isfahan and Mashhad now suffer 8- to 12-hour blackouts during winter, while IRGC mines run 24/7.How Much Is the IRGC Making?

No one knows the exact numbers. Iran doesn’t release official data. But experts estimate there are around 180,000 mining devices operating in the country. Roughly 80,000 belong to private citizens. The rest-up to 100,000 units-are controlled by state-backed entities. Each ASIC miner consumes about 3,000 watts per hour. Multiply that by 100,000 machines, and you’re looking at 300 megawatts of continuous power demand. That’s enough to power 2 million Iranian homes. And since electricity costs the IRGC next to nothing, their profit margins are astronomical. Bitcoin prices fluctuate, but even at $30,000 per coin, these operations generate hundreds of millions of dollars annually. The money doesn’t go into Iran’s national treasury. It flows into IRGC-controlled accounts, used to fund proxy militias in Syria, Yemen, and Iraq. U.S. Treasury reports and Israeli intelligence have traced Bitcoin transactions from Iranian mining farms directly to Hezbollah and Hamas wallets.

The Energy Crisis Is No Accident

Iran’s energy crisis isn’t caused by drought or aging infrastructure alone. It’s engineered. The country’s electricity grid was never designed for crypto mining. Most power plants are coal- or gas-fired, and they’re already running near capacity. When mining farms demand more power, the grid collapses. Hospitals lose backup power. Factories halt production. Students can’t study after dark. Energy Minister Ali Abadi, a former IRGC commander himself, publicly called unlicensed mining “an ugly and unpleasant theft.” But his words carry little weight. He once led the IRGC’s economic wing. He knows exactly how the system works-and who benefits. In 2024, the Central Bank of Iran tried to crack down. They blocked all local cryptocurrency exchanges from converting Bitcoin to rials. But by early 2025, they quietly reopened the gates-for select, government-approved traders. The new system uses a government-controlled API that tracks every transaction. This isn’t about stopping crypto. It’s about controlling it.How Iranians Are Fighting Back

Ordinary Iranians still mine crypto. But they do it in secret. Some hide rigs in basements. Others use solar panels to avoid the grid. Many use VPNs to access foreign exchanges like Nobitex, bypassing Iranian restrictions entirely. But the risks are high. In 2023, Iranian authorities raided homes in Tehran and confiscated over 5,000 mining rigs. Owners were fined, jailed, or forced to hand over their Bitcoin. Meanwhile, the IRGC’s operations grow larger, with new farms reported in Qom and Yazd. The message is clear: if you’re not connected to the state, you don’t get to profit.

Why the World Should Care

This isn’t just Iran’s problem. It’s a global one. Crypto mining is supposed to be decentralized. But in Iran, it’s become the most centralized form of digital money in the world-controlled by a single military organization with ties to terrorism. Every Bitcoin mined by the IRGC could be funding violence abroad. Every kilowatt stolen from Iranian homes is a stolen chance at a normal life. Western governments have targeted IRGC-linked Bitcoin wallets. The U.S. Treasury has frozen accounts tied to mining operations. But these actions are reactive. They don’t stop the machines from running. The real solution? Pressure on the countries supplying the hardware. China still exports thousands of ASIC miners to Iran every year. Turkey and the UAE serve as transit points. Until global supply chains are shut down at the source, the IRGC will keep mining, keep stealing power, and keep funding war.What’s Next for Iran’s Crypto

Iran’s government won’t ban crypto mining. It’s too profitable. Instead, it will keep tightening control. More state-owned mining farms. More military-run power plants. More bans on private miners. By 2026, experts predict over 70% of Iran’s crypto mining will be under direct IRGC control. Private mining will be nearly extinct. The energy crisis will worsen. And the world will keep watching as a military force turns electricity into weapons. The irony? The very technology meant to free people from centralized control is now being used to lock them in.Is crypto mining legal in Iran?

Technically, yes-but only for state-approved miners. The Iranian government requires licenses and forces miners to sell Bitcoin to the Central Bank at fixed prices. Most private miners can’t afford these rules, so they operate illegally. Meanwhile, the IRGC and affiliated groups mine without licenses, using military power to bypass regulations.

How does the IRGC get electricity for mining?

The IRGC doesn’t pay for electricity. They control power plants, redirect grid lines, and use military infrastructure to siphon subsidized power meant for cities and industries. Some operations are hidden inside bases or religious foundations, making them immune to utility inspections or billing.

Why doesn’t Iran shut down unlicensed mining?

Because the IRGC runs it. Shutting down unlicensed mining would mean cutting off the regime’s main source of hard currency outside the banking system. The IRGC uses Bitcoin profits to fund proxy groups, bypass sanctions, and maintain political power. The government’s crackdowns target only private miners-not the ones with military backing.

Are Iranians using crypto despite the restrictions?

Yes, but only through workarounds. Many use VPNs to access foreign exchanges like Nobitex or Binance. Some trade Bitcoin for goods or foreign currency in black markets. Others mine secretly at home, risking arrest. But the government’s control over domestic transactions makes it nearly impossible to use crypto legally without state approval.

How does crypto mining affect Iran’s power grid?

It’s the leading cause of blackouts. Industrial-scale mining farms consume hundreds of megawatts continuously-enough to power millions of homes. When demand spikes, especially in winter, the grid fails. Hospitals, schools, and factories lose power. The IRGC’s mines, however, never go dark.

What’s being done internationally to stop this?

The U.S. Treasury and Israeli intelligence have frozen Bitcoin wallets linked to IRGC mining operations. Sanctions have been placed on Chinese companies that ship mining hardware to Iran. But enforcement is weak. Without cutting off the supply of ASIC miners and stopping foreign power investments, the IRGC will keep mining.

Comments

Paul McNair

This is the kind of systemic injustice that makes you question everything about how power works in the digital age. The IRGC isn’t just mining Bitcoin-they’re mining human suffering. Every blackout in Tehran, every cold house in winter, every child studying by phone light-it’s all tied to a machine humming in a military compound. And the world just watches. We sanction the money but not the hardware. We freeze wallets but not the power lines. It’s like trying to stop a flood by banning buckets while the dam’s wide open.

China’s still shipping ASICs like it’s Black Friday. Turkey and the UAE? Middlemen with blinders on. Until we treat this like the war economy it is-not just a crypto problem-we’re complicit. The tech was supposed to liberate. Now it’s just another weapon in a regime’s arsenal.

And the irony? The same people who scream about ‘decentralization’ are the ones letting this happen. We want crypto to be free… unless it’s funding terrorism. Then suddenly, it’s a national security issue. Pick a lane, world.

November 29, 2025 at 07:42

Mohamed Haybe

Iran is weak because its people are weak. Let them suffer. If they want power they should have built their own grid not cry about stolen electricity. IRGC is strong. They take what they need. This is not theft this is survival. America has drones Iran has ASICs. Who wins?

November 30, 2025 at 18:26

Marsha Enright

Just wanted to say-this is one of the most chilling, well-documented pieces I’ve read in months. The way they weaponize energy subsidies while punishing ordinary people? That’s not corruption. That’s design.

If you’re a private miner in Iran, you’re a criminal. If you’re IRGC? You’re a national hero. The hypocrisy is breathtaking. And the fact that they’re using religious foundations as fronts? That’s next-level manipulation.

Also-huge props to the people mining in basements with solar panels. That’s real resistance. Not loud, not flashy, just stubbornly alive. Keep going.

PS: If anyone knows of a reputable org pushing for ASIC export controls, I’ll donate. This needs global pressure. 💪

December 2, 2025 at 17:45

Andrew Brady

This isn’t just about Iran. This is a blueprint. The IRGC didn’t invent this-they perfected it. And if you think this is isolated, you’re naive. China is already testing state-controlled crypto mining grids in Xinjiang. Russia is using mining farms to launder sanctions evasion cash. North Korea? They’ve been doing this for years.

The U.S. Treasury’s frozen wallets? Token gestures. They’re not shutting down the factories. They’re not stopping the shipments. They’re not even naming the Chinese companies that ship the rigs. Why? Because the supply chain is too profitable. And because the West is too afraid to cut off the flow of cheap electronics.

Mark my words: in 10 years, every authoritarian regime will have a state-run crypto mining empire. And we’ll be the ones supplying the machines.

This is the new Cold War. And we’re losing.

December 3, 2025 at 12:48

Sharmishtha Sohoni

How many ASICs per facility? What’s the average lifespan? Are they using old models or latest 5nm chips? Who maintains them? Are there worker deaths from overheating? Any data on carbon footprint per mined BTC in Iran vs global average?

December 5, 2025 at 06:59

Althea Gwen

So the tech that was supposed to free us... is now the chains. 🤡⚡️

December 6, 2025 at 09:49