Sidechains Explained: How They Connect Blockchains and Why They Matter

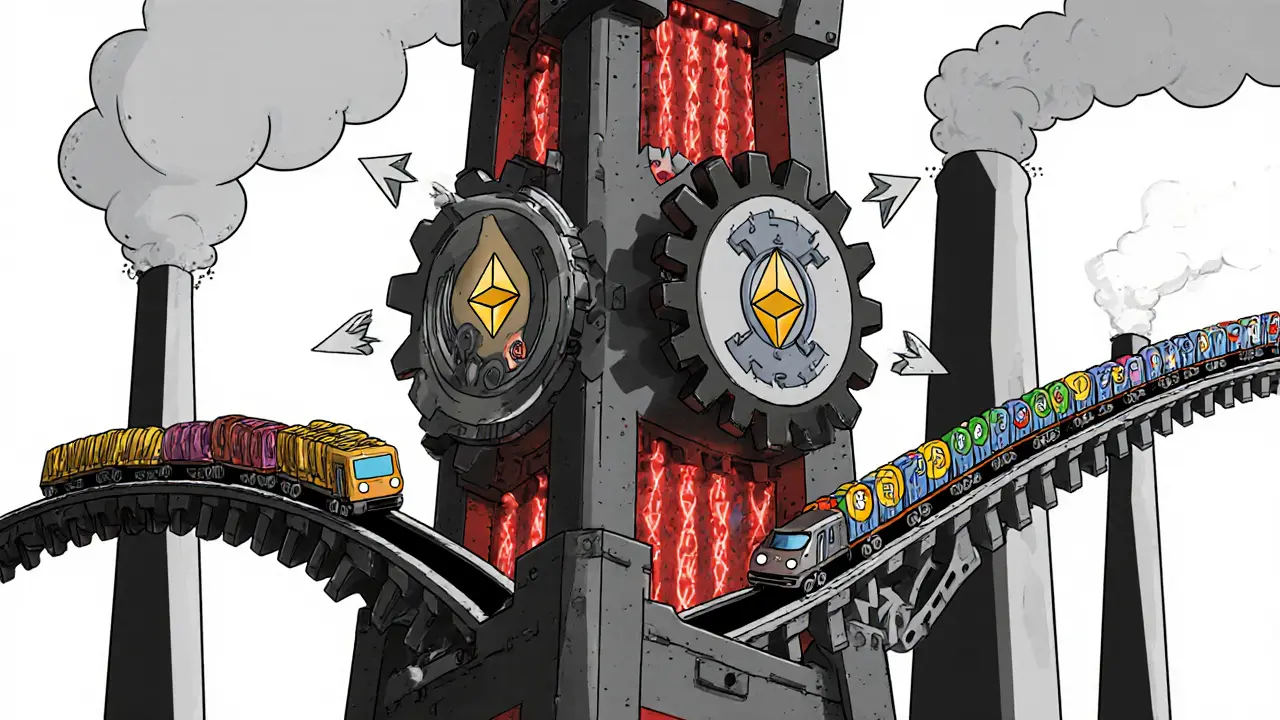

When you hear sidechains, independent blockchains that connect to a main chain like Ethereum to handle transactions more efficiently. Also known as layer-2 networks, they’re not just tech jargon — they’re what keep crypto fast and cheap when the main network gets crowded. Think of them like express lanes on a highway. If every car had to use the main road, traffic would stall. Sidechains take the load off so the main chain doesn’t break down.

They work by locking assets on the main chain and releasing equivalent tokens on the sidechain, letting users trade, stake, or swap without paying $50 in gas fees. This isn’t theory — it’s why platforms like Polygon, Arbitrum, and Optimism exist. These aren’t just names on a list; they’re L2 solutions, blockchain networks built to scale Ethereum by processing transactions off the main chain that handle millions of daily trades. And because they’re connected, you can move your ETH from Ethereum to Polygon and back without using a centralized exchange.

But sidechains aren’t just about speed. They enable blockchain interoperability, the ability for different blockchains to share data and assets securely — something that used to require risky bridges with $100M+ hacks. Now, protocols like Polkadot and Cosmos use sidechain-style tech to let Bitcoin, Ethereum, and Solana talk without trusting third parties. That’s why projects building DeFi apps, NFT marketplaces, or gaming platforms all prefer sidechains: they’re cheaper, faster, and more flexible.

Still, they’re not magic. Some sidechains are centralized — meaning one company controls the validators. Others are permissionless, letting anyone run a node. That’s why you’ll see posts here about failed DEXs like Saturn Network or the rise of Solana-based Serum. Both used sidechain logic, but one survived because the community took over after its parent company collapsed. The difference? Control, transparency, and who really owns the chain.

What you’ll find below isn’t a list of buzzwords. It’s real stories: how sidechains enabled crypto adoption in countries with strict banking rules, how they lowered fees for Nigerian traders using USDT, why some tokens like TOON died because their sidechain lost support, and how Base’s upcoming airdrop ties directly to its sidechain infrastructure. You’ll see how regulatory pressure in Australia and Germany affects sidechain operators, and why Iran’s mining farms rely on sidechains to hide activity. This isn’t abstract tech — it’s what’s happening right now, in real markets, with real money at stake.

Posted by

HELEN Nguyen

6 Comments

Sidechains connect to main blockchains through two-way pegs and bridges, enabling faster, cheaper transactions without compromising main chain security. Learn how Polygon, Ethereum, and others make this work - and where the risks lie.

read more