Sidechain Security: What It Is, Why It Matters, and How It Protects Your Crypto

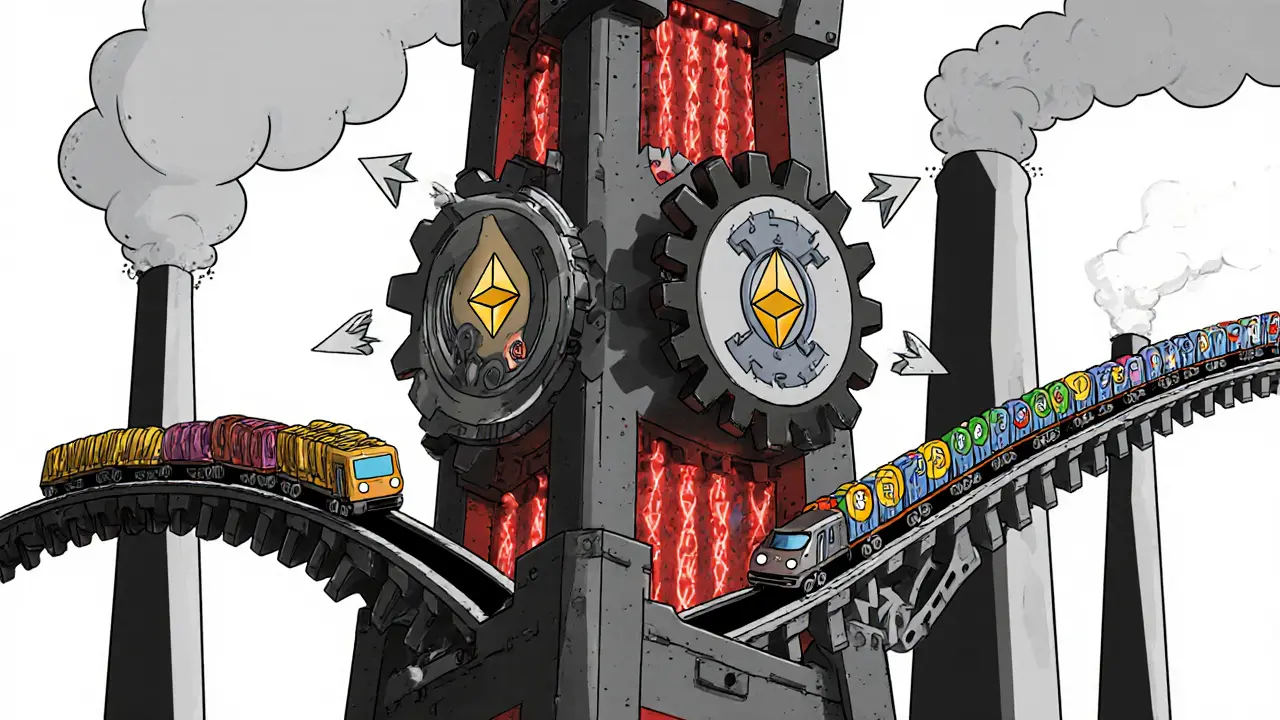

When you move crypto from Ethereum to a faster, cheaper network like Polygon or Arbitrum, you're using a sidechain, a separate blockchain that connects to a main chain to handle transactions more efficiently. Also known as layer-2 chains, these networks let you trade, stake, or swap tokens without clogging up the main blockchain. But here’s the catch: sidechain security isn’t automatic. If the sidechain’s rules are weak, your funds can vanish—fast.

Sidechains work by locking your tokens on the main chain and minting equivalent tokens on the sidechain. That sounds simple, but it’s where things get dangerous. The security of your assets depends entirely on how well the sidechain validates transactions. Some sidechains use their own validators—often fewer than 10—and if those validators are compromised or collude, they can steal funds. Others rely on fraud proofs or zero-knowledge proofs, which are stronger but harder to build. Projects like Polygon use a hybrid model with Ethereum as a final checkpoint, while others, like Ronin, have collapsed under single-point failures. In 2022, one sidechain breach cost over $600 million. That’s not a glitch. It’s a design flaw.

Real sidechain security means more than just fast transactions. It’s about who controls the bridge, how often the chain is audited, and whether users can exit safely if things go wrong. You’ll find posts here about platforms like Shentu that focus on blockchain security with formal verification, and others like Serum DEX that survived after their parent exchange crashed. You’ll also see cases where sidechain bridges were hacked because they trusted too few nodes, or where tokens like UvToken and Pontoon died because their underlying chains had no real security. This isn’t theory—it’s what happened to real people’s money.

What you’ll find below aren’t just articles about sidechains. They’re real-world stories of what happens when security fails: exchanges that vanished, tokens that became worthless, and projects that tried to fix their bridges too late. Some posts warn you about fake platforms like Xevenue and UPXIDE that pretend to be secure. Others show you how regulatory pressure in Australia and Germany forces exchanges to prove their sidechain safety. You’ll learn how to spot a weak bridge, why some chains are safer than others, and how to protect your crypto even when you’re using the fastest networks. This isn’t about hype. It’s about survival.

Posted by

HELEN Nguyen

6 Comments

Sidechains connect to main blockchains through two-way pegs and bridges, enabling faster, cheaper transactions without compromising main chain security. Learn how Polygon, Ethereum, and others make this work - and where the risks lie.

read more