Ethereum: What It Is, How It Works, and Why It Still Rules Crypto

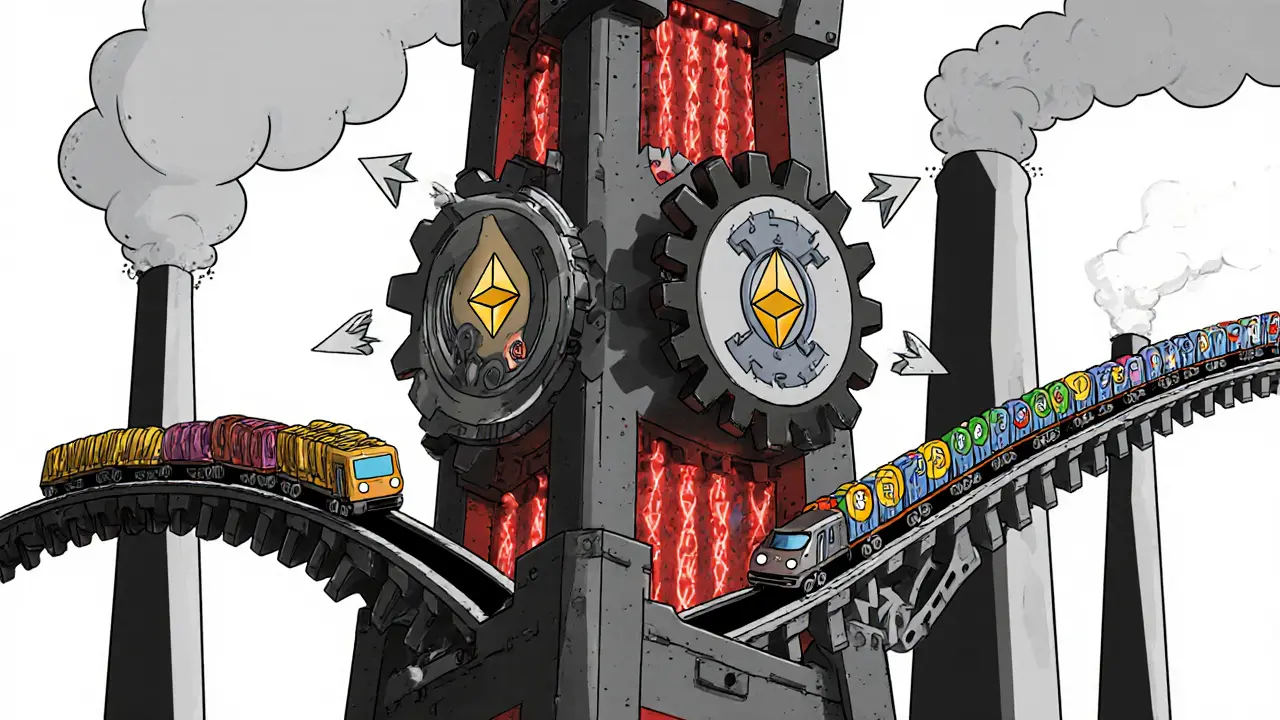

When you think of crypto beyond Bitcoin, you’re probably thinking of Ethereum, a programmable blockchain that runs smart contracts and powers thousands of decentralized apps. Also known as ETH, it’s not just digital money—it’s a global computer anyone can build on. Unlike Bitcoin, which mostly moves value, Ethereum lets developers create apps that run without servers, banks, or middlemen. That’s why you’ll find DeFi platforms, NFT marketplaces, and even voting systems built on it.

Behind Ethereum is the smart contract, self-executing code that automatically enforces rules when conditions are met. Think of it like a vending machine: you put in ETH, the code runs, and you get your NFT or loan without needing a lawyer or bank. This is what made Ethereum the go-to for developers. And because it’s open, anyone can audit the code, fork it, or build on top of it—no permission needed.

But Ethereum isn’t perfect. It’s been through massive upgrades, from moving away from energy-hungry mining to proof-of-stake. That shift cut its energy use by 99.95%, making it far more sustainable. Still, gas fees can spike when the network gets busy, and not all apps are secure—some have been hacked because of bad code, not the blockchain itself. That’s why understanding what’s built on Ethereum matters more than ever.

What you’ll find below isn’t a list of hype. It’s a collection of real stories: exchanges that vanished, tokens that died, airdrops that paid out—and then crashed. You’ll see how Ethereum’s ecosystem shaped those outcomes. Some posts talk about DEXs built on Ethereum, others about regulatory pressure on platforms using its chain. There are warnings about fake apps pretending to be Ethereum-based, and guides on how to tell what’s real. This isn’t theory—it’s what happened to real people using Ethereum in 2025.

If you’ve ever wondered why Ethereum still dominates even after years of competition, the answers are here—not in marketing, but in the wreckage and wins of those who built on it.

Posted by

HELEN Nguyen

10 Comments

Gas fees on Ethereum have dropped 97% since 2023 thanks to Layer 2 solutions like Arbitrum and Optimism. Discover how these networks cut costs, why they're the future, and how to use them today.

read morePosted by

HELEN Nguyen

6 Comments

Sidechains connect to main blockchains through two-way pegs and bridges, enabling faster, cheaper transactions without compromising main chain security. Learn how Polygon, Ethereum, and others make this work - and where the risks lie.

read more