Blockchain Bridges: How They Connect Chains and Why They Matter

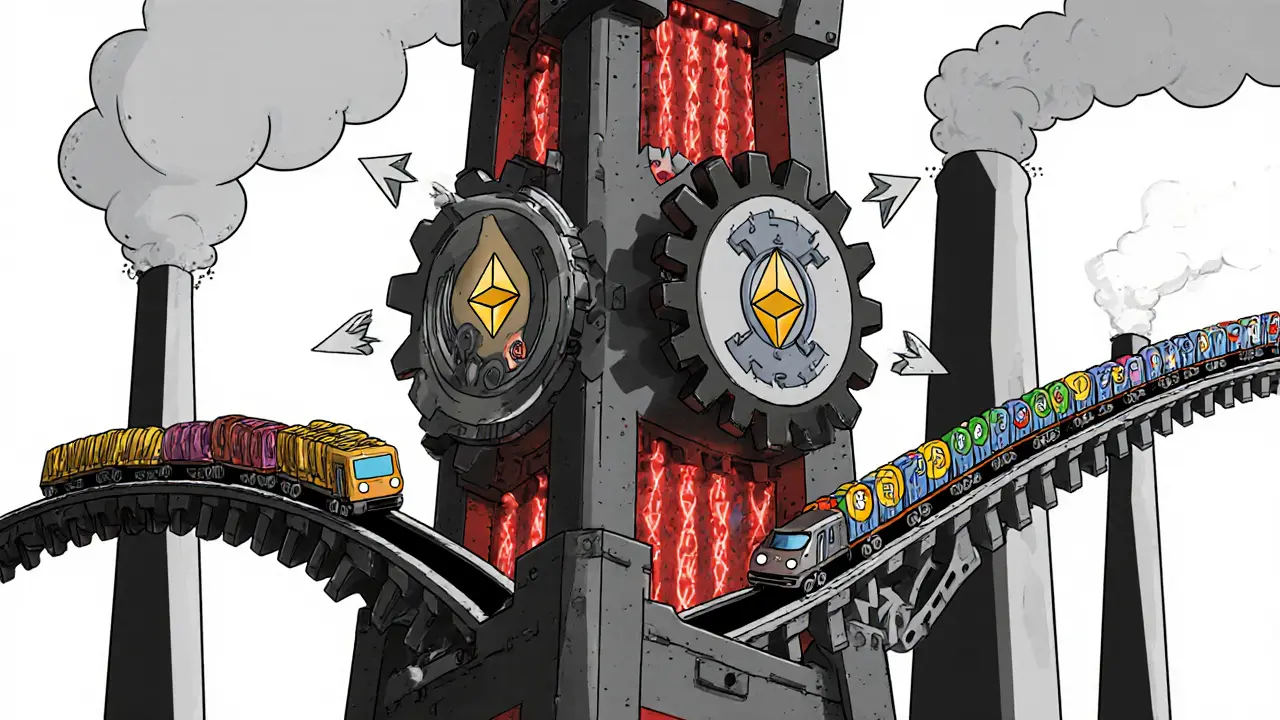

When you send ETH from Ethereum to Solana, you’re not actually moving the coin—you’re using a blockchain bridge, a system that locks assets on one chain and mints equivalent tokens on another. Also known as cross-chain protocols, these tools are the invisible highways that let you use Bitcoin on a DeFi app built on Avalanche, or trade Solana tokens on a platform that only supports Polygon. Without them, each blockchain would be its own isolated island—useful on its own, but locked off from everything else.

But here’s the catch: cross-chain protocols, the underlying tech behind blockchain bridges. Also known as interoperability solutions, they’re only as secure as their weakest link. Over $2 billion has been stolen through bridge exploits since 2021. That’s not because the code is bad—it’s because bridges require trust. Some rely on centralized validators. Others use multi-sig wallets controlled by a handful of teams. If those keys get hacked, your funds vanish. That’s why you’ll see posts here about failed bridges like Pontoon and Saturn Network—they didn’t just stop working, they disappeared with people’s money.

Not all bridges are risky, though. Some, like the ones powering Base or Arbitrum, are built by teams with deep security audits and real-time monitoring. Others, like the ones used in Iran or Tunisia, are run by users bypassing government controls with peer-to-peer setups. The DeFi, decentralized finance ecosystem that relies on cross-chain asset movement. Also known as open finance, it can’t grow without bridges. But it can collapse fast if users don’t know which ones to trust. That’s why you’ll find guides here on how to spot safe bridges, what red flags to watch for, and why some airdrops are tied to bridge activity—because if you’re using a bridge, you’re already part of the chain.

Blockchain bridges aren’t magic. They’re engineering compromises—trade-offs between speed, cost, and safety. And right now, the market is sorting out who’s building the real ones and who’s just selling hype. What you’ll find below aren’t theory pieces. These are real stories: bridges that got hacked, projects that vanished after raising millions, and the few that kept running even after their founders disappeared. If you’re using a bridge today, you need to know what’s on the other side—not just the token, but the team, the audit, the backup plan. Because in crypto, the road between chains can lead anywhere. And sometimes, it leads straight to zero.

Posted by

HELEN Nguyen

6 Comments

Sidechains connect to main blockchains through two-way pegs and bridges, enabling faster, cheaper transactions without compromising main chain security. Learn how Polygon, Ethereum, and others make this work - and where the risks lie.

read more