The M2 crypto exchange launched in October 2023 with a bold promise: to be the M2 crypto exchange for serious investors in the Middle East. It’s not another clone of Binance or Coinbase. It’s built from the ground up for the UAE market-with direct trading in UAE Dirham (AED), institutional-grade tools, and a mobile-first design. But is it any good? And should you use it in 2026?

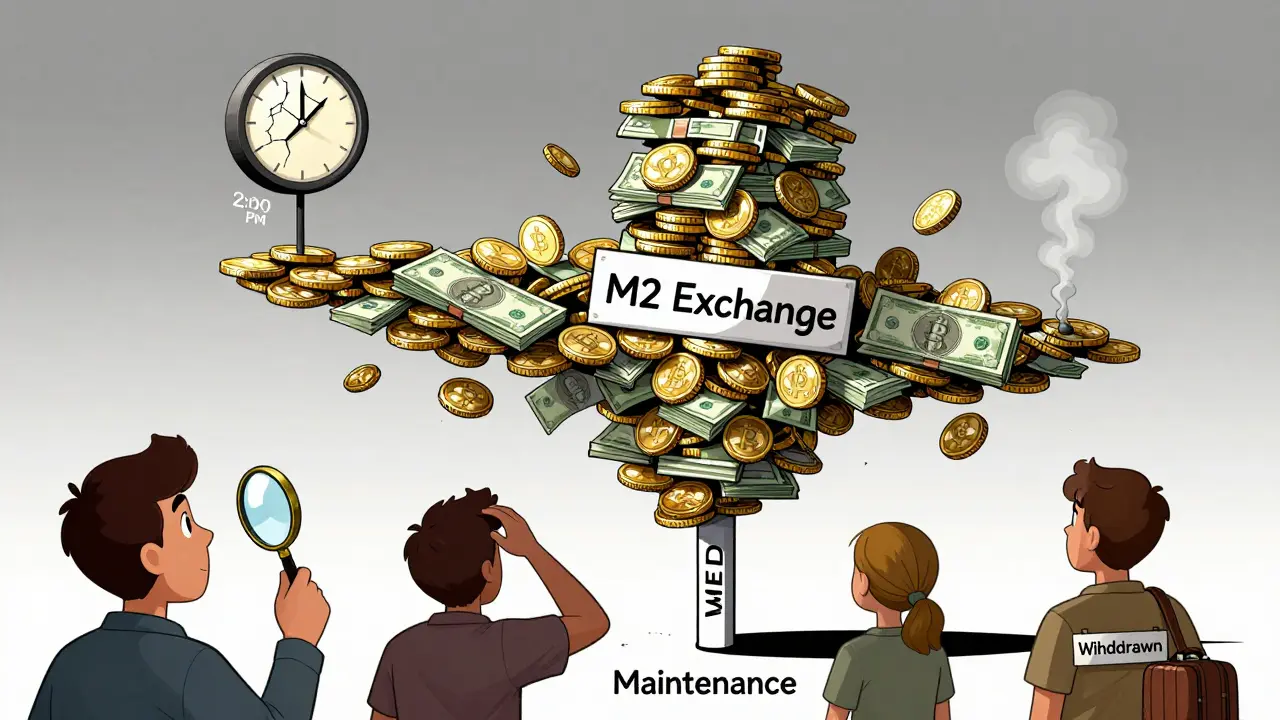

Right now, if you visit m2.com, you’ll see a simple message: "We're currently performing scheduled maintenance." That’s not normal for a platform that’s been live for over two years. It raises a red flag. If a crypto exchange can’t stay online without breaking, what happens when you’re trying to sell during a market dip?

What M2 Actually Offers

M2 isn’t just a trading platform. It’s a full ecosystem. You can spot trade Bitcoin, Ethereum, Solana, and 30+ other coins. But it also has Smart Futures for derivatives, a Smart Spot interface for quick buys, and a currency converter that lets you turn crypto directly into AED without leaving the app. That’s rare. Most exchanges make you use a third-party gateway like Ramp or Mercuryo. M2 handles it all in-house.

Its biggest hook? Earning interest. M2’s "Earn" program promises up to 12% APY on select crypto holdings. Compare that to Coinbase Earn (usually 1-5%) or Binance Savings (3-8% for stablecoins). If you’re holding USDT or USDC, that 12% is hard to ignore. But here’s the catch: the rate changes. Some users report 8% on stablecoins. Others say 12% only applies to newer tokens. There’s no clear breakdown on the site. That’s not transparency-it’s guesswork.

There’s also a native token: MMX. But no one really knows what it does. Is it for fee discounts? Voting? Staking rewards? M2 doesn’t say. That’s a problem. A real utility token should have clear use cases. Without them, it’s just a marketing gimmick.

Who Is M2 Built For?

M2 isn’t for everyone. If you want to trade 500 different altcoins, skip it. With only 30+ assets, you won’t find Shiba Inu, Dogecoin, or obscure DeFi tokens. It’s focused on the big names: BTC, ETH, SOL, XRP, and USDT. That’s fine if you’re a long-term holder or just starting out. But if you’re a day trader chasing memecoins, M2 won’t give you the options you need.

Instead, M2 targets two groups:

- UAE residents who want to trade crypto directly in Dirhams. No more converting to USD or EUR first. You deposit AED, buy Bitcoin, sell it back to AED-all in one place.

- Institutional investors with large holdings. M2 offers an OTC desk for trades over $100,000, custody solutions, and dedicated account managers. That’s something you’d normally only get from Kraken or Gemini.

That’s a smart move. The UAE has over 100 licensed crypto firms. Binance set up its regional HQ in Abu Dhabi in 2021. BitOasis has been around since 2016. M2 isn’t trying to beat them on volume. It’s trying to beat them on service-for people who live here.

The Mobile App Experience

The iOS app (ID: 6446392999) is clean. One user on the App Store wrote: "Best user friendly application that I have meet it's easy to use." They also mentioned "free of trade for spot"-a common new-user perk. M2 gives new users zero fees on spot trades for a limited time. That’s not unique, but it helps.

The interface is simple. No cluttered charts. No 15 different order types. Just buy, sell, earn. That’s good for beginners. But if you’ve traded for years, you’ll miss advanced tools like limit orders with time-in-force, trailing stops, or depth charts. M2 isn’t built for pros. It’s built for people who want to hold crypto, not flip it every hour.

Security and Compliance

M2 says it’s "exceptionally secure." But what does that mean? It doesn’t publish details on cold storage, multi-sig wallets, or insurance coverage. Most top exchanges do. Binance has SAFU fund. Coinbase has FDIC insurance for USD balances. M2? Nothing public. That’s a red flag.

On the bright side, M2 is based in the UAE and operates under VARA (Virtual Assets Regulatory Authority) rules. VARA is one of the strictest crypto regulators in the world. They require audits, KYC, and AML checks. That’s better than being based in an offshore zone with no oversight. If M2 is truly compliant, that’s a strong point. But without public proof, it’s just a claim.

Why You Should Think Twice

M2 has potential. But here’s what’s missing:

- No real community. You won’t find M2 on Reddit, Twitter, or Trustpilot. There are almost no reviews outside the App Store. That’s unusual for a platform this size. Most exchanges have thousands of user stories. M2 has one.

- Unreliable uptime. Scheduled maintenance after 2+ years? That’s not normal. Even during market crashes, Binance stayed up. M2 doesn’t have that track record.

- Too few assets. If you’re serious about crypto, you’ll outgrow M2 fast. You can’t build a diversified portfolio with only 30 coins.

- No clear fee structure. Are futures trading fees 0.05%? 0.1%? No one says. Withdrawal fees? Hidden. You’ll only find out when you try to send crypto out.

And then there’s the maintenance message. If the platform can’t handle routine updates without going down, what happens during a surge in traffic? Or a hack attempt? Or a market panic? That’s the real risk.

Is M2 Worth It?

If you live in the UAE and want to buy Bitcoin with Dirhams-easily, quickly, without third parties-M2 is one of the few options that does it well. The 12% APY on stablecoins is tempting. The mobile app is smooth. The OTC desk is legit for big traders.

But if you’re looking for a long-term, reliable exchange with deep liquidity, tons of coins, and proven uptime? M2 isn’t there yet. It’s still too new. Too quiet. Too fragile.

Think of it this way: M2 is like a new coffee shop in your neighborhood. Great beans, friendly staff, nice vibe. But it’s only been open for 18 months. One day, it closes for "maintenance." You don’t know why. You don’t know when it’ll reopen. Would you put your money in there? Or would you stick with the 10-year-old café down the street?

For now, M2 is a niche tool for UAE residents. Not a global exchange. Not a safe haven. Not a replacement for Coinbase or Kraken. Just a convenient option-if you’re okay with the risks.

Is M2 a legitimate crypto exchange?

Yes, M2 is a legitimate exchange. It’s registered under the UAE’s Virtual Assets Regulatory Authority (VARA), which is one of the strictest crypto regulators globally. It has physical offices in Abu Dhabi, Dubai, and the Bahamas. But legitimacy doesn’t mean safety. Many regulated exchanges have still failed due to poor operations or liquidity issues. Always treat regulated platforms with caution.

Can I trade AED directly on M2?

Yes. M2 is one of the few exchanges that offers direct trading pairs between crypto and UAE Dirham (AED). You can deposit AED, buy Bitcoin or Ethereum, and sell crypto back to AED-all without converting to USD first. This is a major advantage for users in the UAE.

What’s the APY on M2 Earn?

M2 claims up to 12% APY on certain crypto holdings. But this rate isn’t guaranteed. It varies by asset, market conditions, and promotional periods. Stablecoins like USDT often earn 8-10%, while newer tokens might offer higher rates temporarily. Always check the current rate before depositing funds.

Why does M2 have so few coins?

M2 focuses on the top 30 cryptocurrencies, mostly high-market-cap assets like BTC, ETH, SOL, and stablecoins. It avoids low-volume altcoins to reduce risk and simplify the user experience. This makes it less appealing for traders seeking diversification but better for beginners and long-term holders.

Is M2 better than Binance or Coinbase?

No-not for most users. Binance and Coinbase offer hundreds of coins, better liquidity, more tools, and proven uptime. M2 only beats them in one area: direct AED trading and regional focus. If you’re in the UAE and want to avoid third-party payment processors, M2 is a good choice. For everyone else, stick with established platforms.

Should I use M2 if it’s under maintenance?

No. If M2 is showing maintenance messages, don’t deposit funds. Even if you’re just planning to trade later, platform instability is a warning sign. Reputable exchanges rarely go offline for routine updates. If M2 can’t handle maintenance without downtime, it’s not ready for real-world market stress.