The Pontoon (TOON) crypto coin was once promoted as a one-click solution to move assets between blockchains without losing control of your funds. It promised to fix the messy, slow, and risky process of cross-chain transfers - a real problem in 2021 when users were jumping between Ethereum, Binance Smart Chain, Polygon, and dozens of new Layer 2s. But today, Pontoon doesn’t work. It’s not under development. It has no users. And its token is worth less than a penny - down 99.99% from its peak. This isn’t a story about a failed startup. It’s a case study in how hype, bad tokenomics, and zero real utility can turn a $4 million crypto project into a ghost.

What Pontoon was supposed to do

Pontoon launched in October 2021 as a cross-chain liquidity mirroring protocol. That sounds fancy, but here’s what it meant in plain terms: if you had ETH on Ethereum and wanted to use it on Arbitrum, you wouldn’t need to lock your ETH in a bridge, wait 10 minutes, pay high gas fees, and risk getting scammed. Instead, Pontoon claimed it could instantly mirror your assets across chains - meaning your original ETH stayed safely in your wallet, and a copy appeared on the other chain. All you had to do was click once.

The idea wasn’t completely crazy. Other projects like Wormhole and LayerZero were building similar tech, but Pontoon said it could do it faster and cheaper. Its system had three parts: smart contracts on each blockchain (called Bridge Contracts), a network of validators who staked TOON tokens to secure transactions (Proof-of-Stake Relayer Network), and liquidity pools where users could deposit assets to earn TOON rewards.

It was designed for DeFi traders who wanted to chase yield across chains without the hassle. The team said it would be seamless - no complex steps, no long waits. That’s why they raised $3.93 million in funding, including $700,000 in its initial public sale at $0.35 per TOON token.

What actually happened

Within months, the cracks showed.

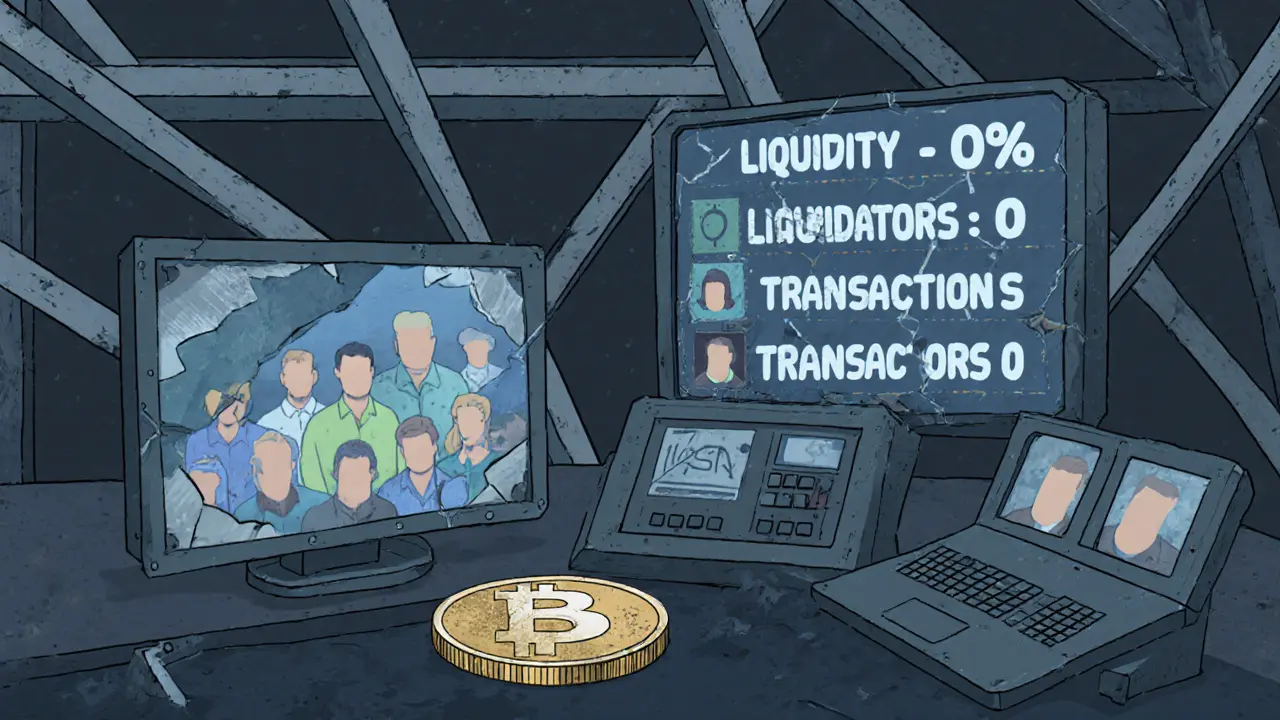

First, the liquidity pools stayed empty. No one deposited assets because there was no guarantee they’d get returned. Validators stopped running nodes because the fees weren’t worth it. By early 2022, there were no verifiable cross-chain transactions recorded on any blockchain explorer. The relayer network - the engine of the whole system - just shut down.

Then came the price crash. TOON hit an all-time high of $0.3300 in November 2021. A year later, it was trading at $0.0003. Today, it’s worth around $0.000001. That’s a 99.99% drop. For people who bought in during the ICO, their $1,200 investment turned into less than $1. Reddit users posted about losing their life savings. Trustpilot reviews averaged 1.2 out of 5 stars, with 11 out of 12 people complaining the liquidity pools were always empty.

By mid-2022, the team stopped posting on Twitter. The official Discord server vanished. The GitHub repo hasn’t been updated since February 2022. The support email bounces. The Telegram group, which had 8,500 members at launch, now has fewer than 300 - and most are just speculators hoping for a miracle pump.

Why Pontoon failed when others succeeded

Pontoon wasn’t the only cross-chain project in 2021. LayerZero raised $225 million. Wormhole got $225 million. Stargate raised $100 million. All of them had real teams, clear roadmaps, and partnerships with major DeFi apps like Aave, Curve, and Uniswap.

Pontoon had none of that. It was built by anonymous developers. No whitepaper. No public team. No integrations. Just a website and a token.

Its biggest flaw was tokenomics. TOON was meant to be used for staking, paying fees, and earning rewards. But as the price crashed, no one wanted to stake it - because if you locked up your TOON and the project died, you lost everything. And since no one was staking, the relayer network couldn’t function. It was a death spiral.

Compare that to LayerZero, which uses a dual-token model (OCT for governance, and a native gas token) and has over 200 blockchain integrations. Or Axelar, which has a decentralized network of over 100 validators from around the world. Pontoon had zero validators left.

Can you still use Pontoon today?

No.

You can’t send assets across chains using Pontoon. The bridge doesn’t work. The liquidity pools are empty. The website still loads, but the “Connect Wallet” button just spins forever. If you try to swap TOON on a DEX like Uniswap, you’ll find only a handful of trades per day - usually from bots or people trying to dump their last tokens.

Even if you still hold TOON, you can’t do anything useful with it. You can’t stake it. You can’t earn rewards. You can’t use it to pay for anything. It’s just a digital file in your wallet with no function.

Some people still trade it on low-volume exchanges like BitMart or Gate.io, hoping for a rebound. But that’s gambling, not investing. There’s no roadmap. No team. No news. No hope.

What does Pontoon teach us about crypto?

Pontoon is a warning label.

It shows how easy it is to launch a crypto project during a bull market. All you need is a slick website, a whitepaper full of buzzwords, and a marketing team that knows how to hype “cross-chain,” “liquidity,” and “one-click.” Investors rush in, hoping to get in early on the next big thing. But if there’s no real product, no team, and no community - it’s just a house of cards.

The projects that survived - like Chainlink, Polygon, and LayerZero - didn’t win because they had the flashiest tech. They won because they solved real problems for real users. They had engineers who showed up every day. They had partners who built on top of them. They had transparency.

Pontoon had none of that.

It’s now classified as “inactive” by CoinGecko, “non-viable” by Messari, and “dead” by DeFi Llama. Its market cap is $448.90. That’s less than the cost of a decent dinner in Boulder. For a project that once raised millions, it’s a tragic end.

What should you do if you own TOON?

If you bought TOON during the ICO or in the early days - you’ve already lost most of your money. The only thing left to do is decide whether to hold or cut your losses.

Hold it if you think there’s a chance someone will revive it. But be honest: there’s zero evidence of that. No code updates. No team statements. No liquidity. No users.

Sell it if you want to recover even a tiny fraction of your investment. Yes, it’s worth almost nothing. But if you’re still holding it, you’re not gaining anything - you’re just waiting for a ghost to come back.

And if you’re thinking about buying TOON now? Don’t. It’s not an investment. It’s a tombstone.

Is Pontoon a scam?

Technically, no - it wasn’t a rug pull. The team didn’t drain the treasury. They didn’t vanish with the money. The $3.93 million raised went into development, marketing, and early operations.

But it was a classic case of overpromising and underdelivering. They sold a vision of a seamless cross-chain future - and then disappeared before building anything real. In crypto, that’s just as damaging as a scam. People lost money because they believed in something that never existed.

As analyst Maria Gomez said in CoinDesk’s 2023 review: “Projects like Pontoon that launched during the 2021 bull market without solving genuine pain points often become victims of market correction when speculative capital retreats.”

Pontoon didn’t fail because of bad luck. It failed because it had no reason to exist.

Comments

Durgesh Mehta

Pontoon was such a classic case of vaporware wrapped in DeFi glitter

Everyone was chasing the next big cross-chain thing and no one asked how it actually worked

I bought some TOON because the website looked slick and the Discord had 8k people

Turns out the only thing flowing was hype

Now I just keep it as a reminder not to fall for shiny objects again

November 29, 2025 at 16:03

Sarah Roberge

okay but like… if the team was anonymous and there was no whitepaper how did anyone think this was a good idea??

i mean seriously

we live in a world where people invest in dog coins with memes as roadmaps but when something looks too perfect it’s automatically a scam??

the irony is that pontoon didn’t even have a meme

just a website with a spinning button and a promise

and now it’s a ghost story for crypto newbies

rip $1200 i never had

November 30, 2025 at 07:20

Jess Bothun-Berg

This is why you don’t invest in projects without a team. No. Team. No. Accountability. No. Whitepaper. No. Code. No. Future. Just. A. Token. With. A. Website. That. Still. Loads. Because. Someone. Paid. For. Hosting. And. Now. It’s. A. Digital. Graveyard. With. A. 99.99% Drop. And. Zero. Hope. You. Were. Warned.

December 1, 2025 at 04:22

Steve Savage

It’s wild how much of crypto is about storytelling, not engineering

People don’t buy tokens-they buy narratives

Pontoon sold the dream of frictionless cross-chain movement

And for a hot second, it felt real

But dreams don’t pay validators or keep servers running

The real winners? The ones who walked away before the crash

Not because they were smart

But because they were skeptical

And that’s the only skill that matters in this space

December 1, 2025 at 05:55

Joe B.

Let’s break this down statistically: 99.99% drop = 10,000x decline

Market cap now $448.90? That’s less than a Bitcoin miner’s monthly electricity bill in Texas

And the fact that it’s still trading on BitMart? That’s not liquidity-that’s corpse recycling

Bot-driven volume, zero real demand, and a handful of delusional HODLers clinging to the idea that ‘this time it’s different’

Meanwhile, LayerZero has 200+ integrations, 100+ validators, and real enterprise partnerships

Pontoon had a Figma mockup and a Twitter thread

It’s not a failure-it’s a mathematical inevitability

And the people who bought in? They didn’t lose money

They paid for a lesson in cognitive bias

And now they’re still checking the price every morning

Like it’s going to wake up and say ‘surprise!’

It won’t. It’s dead. Let it rest.

December 1, 2025 at 20:11

Rod Filoteo

you think this was just bad luck??

nah

they took the money and ran

but not like a rug pull-oh no

they just vanished quietly like ghosts in a horror movie

no one saw it coming because everyone was too busy chasing yield

but i knew

i told my friend dont touch it

he said 'but the website looks legit' 😭

now he's crying in the discord with 298 other zombies

and the devs? Probably in thailand with a yacht and a new project called 'SkyBridge' that does the same thing

crypto is a pyramid where the top 1% make the rules and the rest of us just buy the hype until the lights go out

and the worst part?

we keep coming back for more

December 3, 2025 at 08:29

Layla Hu

I held TOON for a few months hoping it’d recover. It didn’t.

I sold the last bits last month for $0.0000008.

It’s not about the money anymore.

It’s about not letting it take up mental space.

Let it go.

December 4, 2025 at 02:26

Nora Colombie

Why do Americans keep letting anonymous teams take their money?

Europeans at least have some regulation.

China bans this stuff.

India? They’re starting to crack down.

But here? You get a website, a Discord, and a promise-and people throw away life savings like it’s a TikTok trend.

This isn’t innovation.

This is national embarrassment.

And now we’re supposed to feel bad for the losers?

No.

They chose to gamble.

And in crypto? The house always wins.

Especially when the house doesn’t even exist.

December 5, 2025 at 00:03