Most people hear "MilkyWay (MILK)" and think it’s just another meme coin or random crypto project. But that’s not even close to the truth. MilkyWay isn’t trying to go viral on TikTok - it’s building the backbone of a new kind of blockchain economy. It’s a MILK coin tied to a real, working protocol that’s already locking up over $176 million in value. And it’s not just another staking platform. It’s the first system designed specifically for modular blockchains - a growing tech shift that’s changing how blockchains scale and secure themselves.

What problem does MilkyWay actually solve?

Imagine you stake your TIA (Celestia) tokens to help secure the network. Great. You earn rewards. But here’s the catch: while your tokens are staked, you can’t use them anywhere else. No trading. No lending. No earning DeFi yields. You’re stuck. That’s the classic staking dilemma: lock up your money to earn rewards, but lose all liquidity. MilkyWay fixes this. Instead of locking your TIA, you deposit it into the MilkyWay protocol. In return, you get milkTIA - a liquid token that’s pegged 1:1 to your original TIA. But here’s the twist: milkTIA doesn’t just sit there. It keeps earning staking rewards, and you can use it anywhere - in lending apps, liquidity pools, or even restake it again. You’re not choosing between security and liquidity anymore. You get both.How does MilkyWay work? Three layers of returns

MilkyWay’s secret isn’t magic. It’s layered architecture. When you stake through MilkyWay, you unlock three income streams from one deposit:- Layer 1: Base staking rewards - You earn the same yield as if you staked directly on Celestia, Initia, or Babylon. This comes from validating transactions on those chains.

- Layer 2: DeFi yield - Your milkTIA, milkINIT, or milkBABY tokens can be used in DeFi protocols like lending platforms or automated market makers. You earn extra interest just by holding them.

- Layer 3: Restaking rewards - This is the game-changer. You can take your milkTIA and use it to secure other blockchain services called Active Validator Services (AVS). These are smaller, specialized chains that need security but can’t afford to run their own validator sets. MilkyWay lets you lend your staked power to them - and get paid for it.

This "triple return" model is almost unheard of. Most platforms offer one or two of these. MilkyWay delivers all three at once. And you don’t need to move your assets around manually - the protocol handles it all.

What’s the MILK token for?

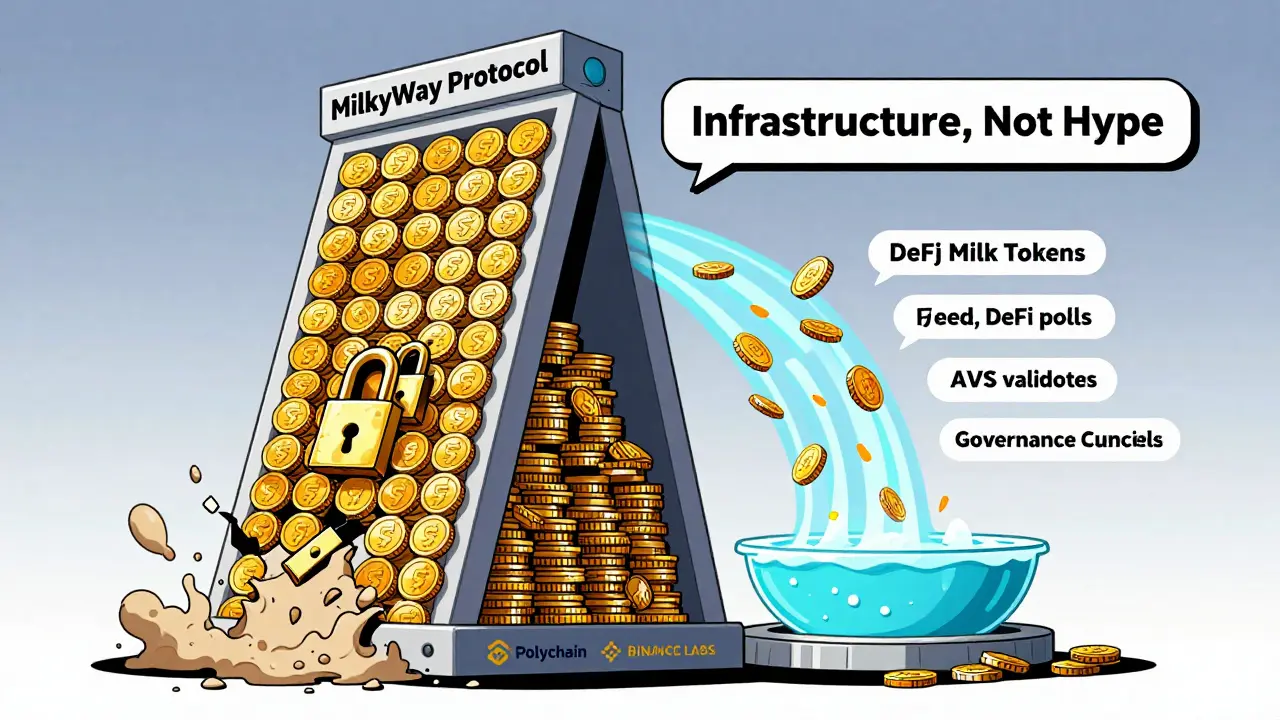

The MILK token launched in April 2025, months after the core protocol went live. It’s not a currency for payments. It’s the governance and revenue-sharing token of the MilkyWay ecosystem.- Governance - Holders vote on protocol upgrades, fee structures, and which new blockchains get added.

- Revenue sharing - A portion of fees generated from staking and restaking flows back to MILK holders.

- Ecosystem incentives - Used for rewards, airdrops, and developer grants to grow the network.

The total supply is capped at 1.2 billion MILK. As of February 2026, around 398 million are in circulation. That means over 70% of tokens are still locked up or unissued - a sign the team is planning for long-term growth, not quick cash-outs.

Real numbers: Is anyone using it?

Numbers don’t lie. MilkyWay didn’t just launch - it exploded.- Within two months of launching, it hit $51 million in Total Value Locked (TVL).

- By late 2025, TVL crossed $176 million. Some trackers show it near $190 million.

- It’s backed by Polychain Capital and Binance Labs - two of the most respected names in crypto investing.

- It supports TIA (Celestia), INIT (Initia), and BABY (Babylon), with more chains planned.

This isn’t a vaporware project. It’s infrastructure. And infrastructure doesn’t go viral - it gets adopted. The fact that institutional investors and real users are locking up hundreds of millions in value says more than any marketing campaign ever could.

Why is MilkyWay different from other staking platforms?

Most staking services - like Lido or Rocket Pool - focus on one blockchain. MilkyWay is built for the future: modular blockchains. Modular blockchains split functions. One chain handles data, another handles execution, another handles security. This is the next evolution after Ethereum. But these chains need security. MilkyWay steps in and lets users provide that security - and get paid for it - without having to run nodes. Compare that to traditional staking:| Feature | MilkyWay | Traditional Staking (e.g., Lido, Rocket Pool) |

|---|---|---|

| Supported chains | Modular blockchains (Celestia, Initia, Babylon) | Single chains (Ethereum, Solana) |

| Liquid tokens | milkTIA, milkINIT, milkBABY - usable in DeFi | stETH, rETH - mostly for staking only |

| Restaking | Yes - earn rewards by securing AVS | No |

| Triple yield | Yes - staking + DeFi + restaking | One or two max |

| Developer support | Provides security infrastructure for new chains | None |

MilkyWay doesn’t just stake your coins. It turns them into infrastructure. And infrastructure gets paid - repeatedly.

What’s the MILK token price doing?

Let’s be honest: the price has been wild.- All-time high: $0.2917

- All-time low: $0.0011

- Current price (Feb 2026): ~$0.0031

- 24-hour volume: ~$1.87 million

That’s a 98.95% drop from its peak. But here’s what most people miss: it’s also up 170% from its lowest point. The token is in recovery mode. Volatility like this is normal for a new governance token that just launched. The real story isn’t the price swing - it’s the $190 million in TVL behind it. The protocol is working. The token just hasn’t caught up yet.

Short-term traders are getting crushed. But long-term holders who believe in modular blockchains are watching the ecosystem grow - not the price chart.

Who’s behind MilkyWay?

MilkyWay wasn’t built by anonymous devs. It was founded by a team with deep roots in Cosmos ecosystem development. Their backers? Polychain Capital - the firm that backed Solana and Avalanche - and Binance Labs, the venture arm of the world’s largest crypto exchange. This isn’t a side project. It’s a serious infrastructure play. The team’s roadmap includes adding more chains, integrating stablecoins, and building bridges between modular ecosystems. They’re not chasing hype. They’re building the plumbing for the next generation of blockchains.

Is MilkyWay safe?

Security is the biggest concern with any new DeFi protocol. MilkyWay uses two key methods:- Authz delegated multisig - For Celestia, it uses a secure multi-signature system approved by the Celestia core team.

- Dedicated Layer 2 chain - For Initia, it runs its own secure application chain, isolated from the mainnet.

Both designs have been audited and are actively monitored. There have been no exploits or hacks. That’s rare for a protocol this complex.

Still, always use trusted wallets like Keplr or Binance Wallet. Never send funds to unknown contracts. And never stake more than you’re willing to lose - even with strong backing, crypto is still crypto.

What’s next for MilkyWay?

The roadmap is clear:- Add more modular chains (like new INIT instances and Babylon extensions)

- Integrate stablecoins for restaking (think USDC, DAI)

- Expand to mainstream assets (BTC, ETH via wrapped versions)

- Launch a mobile app for easier staking and tracking

The goal? Become the default liquidity and security layer for modular blockchains. If that happens, MILK could become as essential as ETH is to Ethereum - not because it’s a currency, but because it’s the fuel that keeps the whole system running.

Is MilkyWay (MILK) a good investment?

It depends on your goals. If you’re looking for a quick flip, probably not - the token is still volatile. But if you believe in modular blockchains and want exposure to infrastructure that’s already locking up $176 million, then yes. The protocol works. The team is credible. The TVL proves adoption. The token price may take time to catch up, but the underlying value is real.

Can I stake TIA without using MilkyWay?

Yes, you can stake TIA directly on Celestia. But you won’t get liquid tokens. You won’t be able to use your staked assets in DeFi. And you won’t earn restaking rewards. MilkyWay gives you more options - and more returns - from the same TIA.

What’s the difference between milkTIA and stTIA?

stTIA is a liquid staking token from Celestia’s native staking system. milkTIA is MilkyWay’s version - but it’s designed to work with restaking and DeFi. milkTIA can be used in lending apps, yield farms, and to secure other blockchains. stTIA usually can’t. Think of milkTIA as stTIA with superpowers.

Is MilkyWay only for Celestia?

No. MilkyWay started with Celestia, but now supports Initia and Babylon too. It’s designed to add more chains - including Ethereum via wrapped assets. Its goal is to become the universal staking layer for modular blockchains, not just one.

Do I need to hold MILK to use MilkyWay?

No. You can stake TIA, INIT, or BABY and receive milkTIA, milkINIT, or milkBABY without owning any MILK tokens. MILK is only needed if you want to vote on governance or earn revenue shares. The core staking service is open to everyone.

Final thought: It’s not about the coin - it’s about the system

MilkyWay isn’t trying to be the next Dogecoin. It’s trying to be the invisible engine behind the next wave of blockchain innovation. The MILK token is just the key that unlocks governance and rewards. The real value is in the protocol - the way it lets you earn from staking, DeFi, and restaking all at once.If modular blockchains become the standard - and they’re already gaining momentum - then MilkyWay won’t be a coin you trade. It’ll be the infrastructure you rely on.