When you buy a token, are you buying a tool to use a service-or are you buying a share in a company? That’s the utility token vs security token question that decides whether a project breaks the law or stays on the right side of it. In 2026, this isn’t just a technical detail-it’s the line between a legal blockchain product and an unregistered securities offering that could get shut down by regulators.

What the SEC Really Looks For

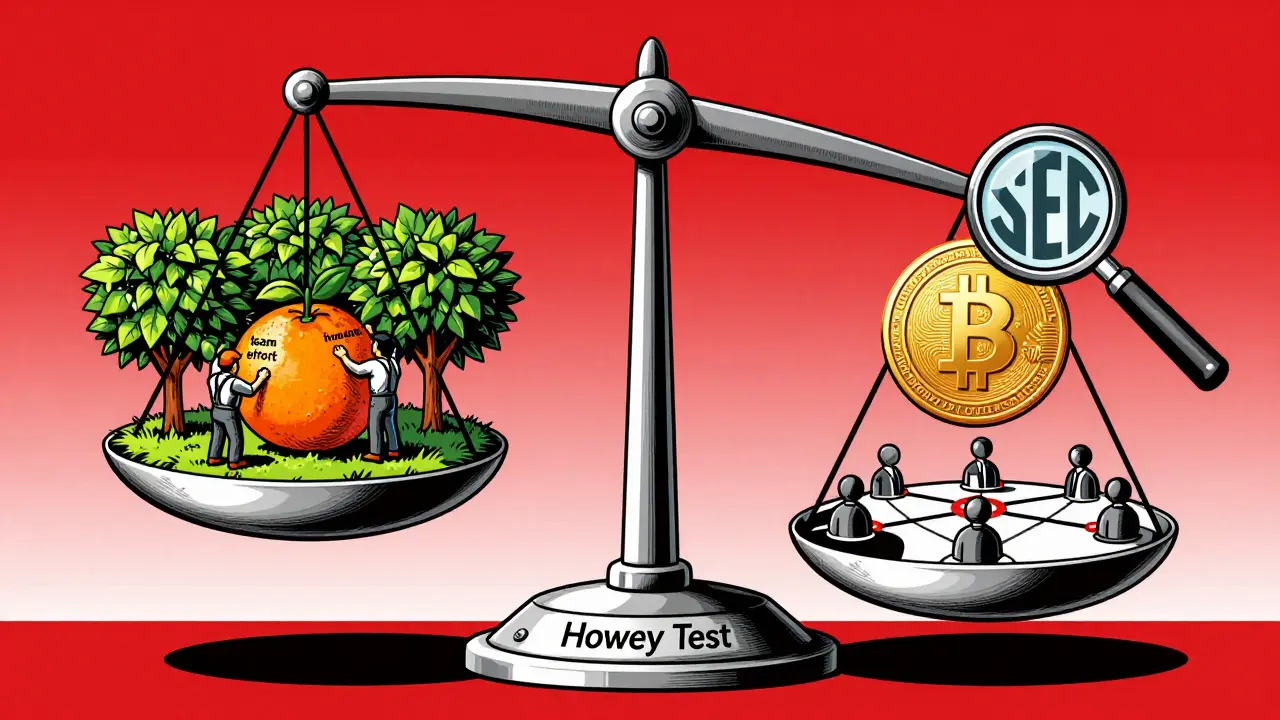

The U.S. Securities and Exchange Commission doesn’t care what a token is called. It doesn’t matter if it says "utility token" on the whitepaper. What matters is how it’s sold and what buyers expect. The legal test used since 2017 is the Howey Test, from a 1946 Supreme Court case about orange groves. Yes, really. The court ruled that selling shares in orange groves where buyers relied on the seller’s labor to make profits counted as an investment contract-and thus a security. Today, that same logic applies to crypto. If people buy your token because they believe you (or your team) will work hard to make the token’s price go up, and they’re not buying it to use a service, then it’s a security. The SEC made this clear in its 2017 DAO Report and reinforced it in cases like Kik Interactive in 2019, where the company paid $5 million for selling Kin tokens as "utility" while marketing them as investments.Utility Tokens: Access, Not Ownership

A utility token gives you access to something. Think of it like a concert ticket or a prepaid gift card. You don’t own part of the venue-you just get to use it. Ethereum’s ETH is the clearest example. People buy ETH to pay for gas on the network, to stake, or to trade on DeFi apps. The SEC confirmed in 2018 that ETH isn’t a security because its value comes from network usage, not from someone else’s efforts to make it profitable. Other utility tokens include:- IXS Token: Grants access to trading tools on IX Swap’s DeFi platform

- Filecoin (FIL): Pays for decentralized cloud storage

- Chainlink (LINK): Used to pay node operators for data feeds

Security Tokens: Digital Shares

A security token is a digital version of a stock, bond, or real estate deed. It represents ownership in a real-world asset. Tradeflow eNote™, for example, is a tokenized debt instrument backed by commercial real estate. Holders get interest payments. If the property sells, they get a share of the profits. Security tokens are issued through Security Token Offerings (STOs), which must follow strict rules. In the U.S., they must either register with the SEC or qualify for an exemption like Regulation D (for accredited investors only). Costs to launch a compliant STO range from $100,000 to $500,000, mostly because of legal, audit, and compliance work. They’re traded on regulated platforms like Switzerland’s SIX Digital Exchange, which processed over CHF 1 billion in security token trades in early 2023. Institutional investors love them because they offer legal protection, dividends, and audit trails-something traditional private equity lacks.

How the Same Token Can Become a Security Overnight

Here’s the trap most projects fall into: they start with good intentions. They build a platform. They sell tokens to fund development. They promise nothing-just "access." But then the platform grows. The team improves it. The token’s price surges. Investors start buying it because they think the team will keep making it better-and the price will keep rising. That’s when regulators step in. In March 2023, a Reddit user shared how their project got an SEC inquiry 18 months after launch. Their token had been fine-until its price jumped 300% after a major upgrade. Suddenly, it looked like an investment. The team hadn’t changed the token’s design. But the market’s behavior had. And under the Howey Test, that’s enough. Naval Ravikant put it bluntly: "90% of tokens sold as 'utility' during ICOs in 2017-2018 would likely be classified as securities under current SEC guidance." That’s not an exaggeration. Many projects back then used "utility" as a legal loophole. Today, the SEC is closing it.Regulatory Differences Around the World

The U.S. isn’t the only player. But it’s the most aggressive. Other countries have clearer rules:- Switzerland (FINMA): Classifies tokens as payment, utility, or asset (security). Asset tokens = securities. Clear, predictable.

- Singapore (MAS): Uses a similar framework. Focuses on economic substance, not labels.

- European Union (MiCA): Effective in 2024. Defines utility tokens as non-financial, with exemptions for tokens that don’t promise returns. Requires transparency but avoids blanket classification.

- United States (SEC): No clear law. Just enforcement. Projects get sued after the fact. That’s why 68% of blockchain teams now hire securities lawyers before launching a token-up from 22% in 2018.

Why the Distinction Matters for You

If you’re a developer building a decentralized app:- Design your token to be used, not speculated on.

- Avoid phrases like "invest in our project" or "we’ll make your token worth more." Even saying "we’ll increase demand" can be risky.

- Make sure the token’s value comes from actual usage-not from team performance.

- Don’t centralize control. If only your team can upgrade the system, regulators see a "common enterprise." That’s a red flag.

- Security tokens give you legal rights: dividends, voting, liquidation priority. Utility tokens? None.

- Security tokens are harder to buy-you usually need to be accredited. Utility tokens? Anyone can buy them on Uniswap.

- Utility tokens can crash if the app dies. Security tokens can still have value if the underlying asset (like real estate) holds up.

What’s Next? Hybrid Models and Regulatory Clarity

The future isn’t utility OR security. It’s both. Projects like Avalanche are testing dual-token systems: one token for paying fees (utility), another for governance and profit-sharing (security). This splits the functions cleanly-making compliance easier. Gartner predicts that by 2026, 65% of security tokens will be tied to real estate and private equity. Utility tokens will keep powering DeFi, gaming, and Web3 apps. The market for utility tokens is massive-over $950 billion in market cap as of late 2023. Security tokens are smaller but growing fast, projected to hit $22.5 billion by 2025. The real win? Regulatory clarity. When the SEC finally defines what a utility token is-not by lawsuit, but by law-innovation will surge. Until then, projects that treat the Howey Test as a checklist, not a suggestion, will survive. The rest will get caught.Can a utility token become a security later?

Yes. The SEC doesn’t classify tokens at launch-it watches how they’re used. If a token’s price rises because users believe the team is making the platform more valuable, and buyers aren’t using it for its intended function, regulators may reclassify it as a security. This happened with Kik’s Kin token and has been flagged in multiple SEC inquiries since 2020.

Is ETH a security?

No. The SEC publicly stated in 2018 that Ethereum’s native token, ETH, is not a security. Why? Because its primary purpose is to pay for transactions and services on the Ethereum network. Its value comes from network demand, not from the efforts of a central team to generate profits for holders.

Do I need a lawyer to issue a utility token?

Technically, no-but you should. While utility tokens aren’t subject to securities laws, they still face AML, tax, and consumer protection rules. More importantly, the line between utility and security is blurry. A single phrase in your whitepaper or marketing video can trigger an SEC investigation. Most projects now spend $20,000-$100,000 on legal review before launch to avoid costly enforcement actions.

Can non-accredited investors buy security tokens?

Only under specific exemptions. In the U.S., most security tokens are sold under Regulation D, which limits buyers to accredited investors (those with $1M+ net worth or $200K+ income). Some platforms use Regulation A+ or Regulation Crowdfunding, which allow non-accredited investors-but with strict limits on how much they can invest and mandatory disclosures.

What’s the biggest mistake projects make with token classification?

Assuming the name "utility token" makes it legal. The SEC looks at economic substance, not labels. If your token is marketed as an investment, priced based on expected returns, or controlled by a central team that drives its value, it’s a security-even if you call it a "membership pass." The most successful projects avoid any language that ties token value to team performance or profit expectations.

Comments

Bonnie Sands

lol the SEC is just scared because they can't tax crypto profits properly. they're using the Howey Test like it's a magic wand to shut down anything they don't understand. remember when they tried to regulate Bitcoin as a currency? total fail. now they're just chasing shadows. if you're not buying a token to use it, you're a dumb investor anyway. the market will sort it out. they're gonna regret this when the next bull run hits and everyone's laughing at their paperwork.

January 22, 2026 at 14:35

MOHAN KUMAR

utility token = used. security token = bought for price rise. simple. if team makes project better and price goes up? that's normal. but if you tell people 'buy this and get rich' = security. no need for lawyers to overcomplicate. just be honest. if your token does nothing but sit in wallets? you're selling shares. stop lying to yourself.

January 22, 2026 at 18:56

Jennifer Duke

Honestly, I'm just shocked that anyone still thinks the U.S. is behind on this. The EU's MiCA is *so* much more elegant - structured, clear, and actually designed for innovation. Meanwhile, here we are in the Wild West, suing people after they've already spent millions. It's embarrassing. Switzerland has had it right for years. Why are we still clinging to 1940s case law? I mean, really. It's not 1946 anymore. We're in 2026. Can we please grow up?

January 22, 2026 at 19:17

Ashok Sharma

Good explanation. Many developers miss the point that token utility must be real and immediate. If your app needs 10,000 users to make the token valuable, but only 500 are using it, then the token is not utility - it's speculation. Focus on usage, not hype. Build something people need to use daily. That’s the only safe path.

January 24, 2026 at 19:11

Darrell Cole

everyone says ETH isn't a security but they ignore that Vitalik and the EF control upgrades and gas fees and block production and the entire roadmap. if you're relying on a central team to make your asset valuable then it's a security by definition. the SEC is right to be suspicious. the fact that people still believe the 'ETH is utility' myth shows how brainwashed the crypto community is. they don't want to face reality. the whole thing is a house of cards built on semantics

January 26, 2026 at 01:04

Matthew Kelly

the hybrid model is the future 😊 one token for gas, one for voting + dividends. clean, legal, smart. no more confusing labels. just function. i'm so tired of people arguing over names instead of building. this is how we move forward.

January 26, 2026 at 21:52

Dave Ellender

Interesting how the SEC's approach is reactive rather than proactive. It forces innovation into legal gray zones. Other jurisdictions are building frameworks first. That's not just regulation - it's strategy. The U.S. risks losing its tech leadership by treating innovation like a crime scene.

January 27, 2026 at 07:24

steven sun

so many projects think they can just say 'utility' and be fine but the market dont care about your whitepaper. if ppl buy it because they think its gonna pump then its a security. no magic words. just real use or its gone. stop playing games. we all know the truth.

January 28, 2026 at 14:48