When you're building a crypto product-whether it's a new wallet, a DeFi protocol, or a tokenized asset-you don't just need code. You need clarity. And in a world where regulations shift faster than market trends, that clarity is rare. That's where regulatory sandbox programs for crypto come in. These aren't just loopholes or favors. They're structured, supervised testing environments where crypto companies can try out real products without immediately facing full regulatory penalties. Think of them as crash courses in compliance, run by regulators themselves.

How Regulatory Sandboxes Actually Work

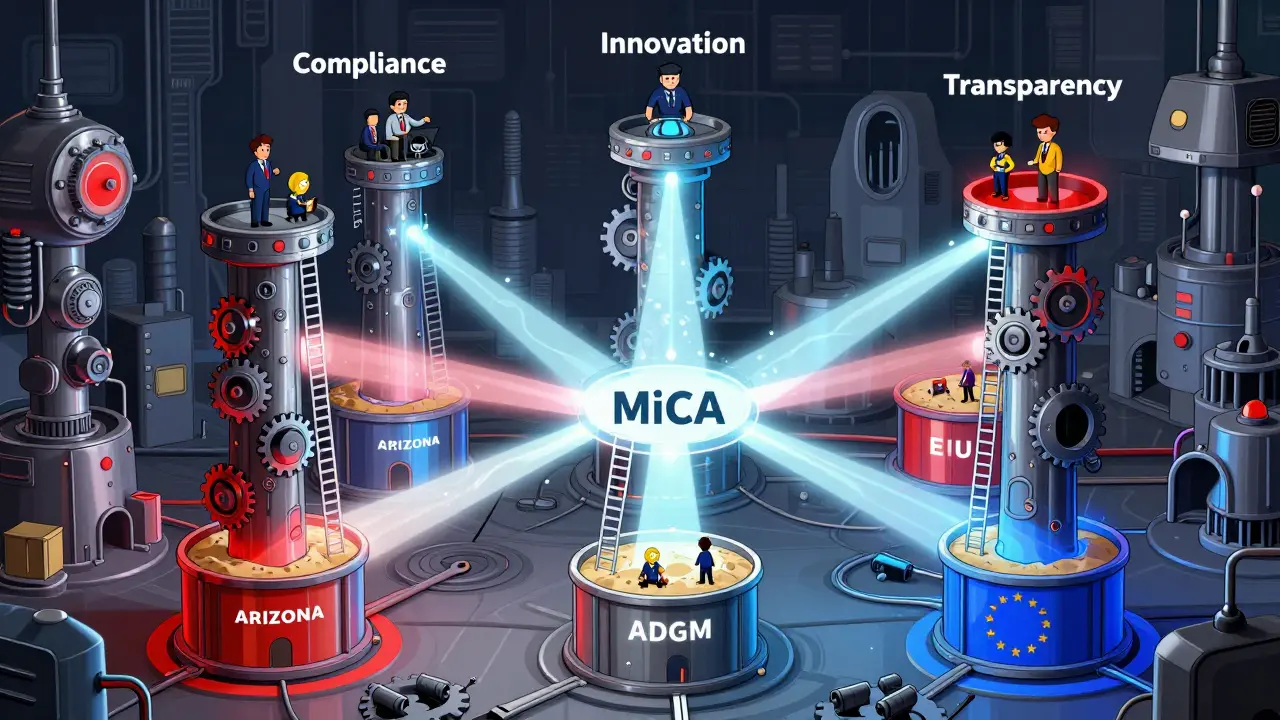

A regulatory sandbox isn't a free-for-all. It's a controlled experiment. Companies apply to join, prove they have a working prototype, and agree to strict rules: limited time (usually 6-24 months), clear boundaries on who can use the product, full transparency with regulators, and real-time reporting. In return, they get temporary relief from certain licensing rules, reporting burdens, or capital requirements that would normally block early-stage testing. For example, in Arizona’s Financial Technology, Digital Assets and Blockchain Sandbox Program, a startup developing a blockchain-based remittance tool can test it with real users-up to 5,000 people-without needing a full money transmitter license. Regulators watch closely, collect data, and adjust rules based on what they see. This isn’t theory. It’s live testing under supervision. The same logic applies in the European Union’s Blockchain Regulatory Sandbox, launched in 2023. Unlike U.S. state programs that often grant exemptions, the EU model doesn’t let companies skip rules. Instead, it gives them direct access to legal experts from national and EU-level authorities. Companies get tailored advice on how to comply with AML, KYC, smart contract liability, and consumer protection laws-all while testing their product. This turns compliance from a barrier into a collaborative process.Why This Matters for Crypto Startups

Crypto startups face a brutal reality: they can’t wait years for regulations to catch up. If they launch without clarity, they risk fines, shutdowns, or lawsuits. If they wait for clear rules, they lose market timing. Sandboxes solve this. Take a small team in Lisbon building a decentralized identity system. Without a sandbox, they’d either abandon the project or risk operating illegally. With the EU sandbox, they can submit their project, get feedback from blockchain specialists and legal advisors, test with real users, and refine their design-all while staying within legal boundaries. By the time they’re ready to scale, they already know how to comply with MiCA, the EU’s new crypto regulation. In the U.S., states like Wyoming and Utah have created sandboxes that attract blockchain firms because they offer predictable, transparent rules. Wyoming’s program explicitly includes digital assets as a distinct asset class, giving crypto-native companies a legal footing they can’t get in most states. This isn’t just convenience-it’s survival.How Different Regions Compare

Not all sandboxes are built the same. Here’s how the major players stack up:| Region | Administered By | Key Features | Eligibility | Duration |

|---|---|---|---|---|

| United States (Arizona) | Arizona Corporation Commission | Exemptions from licensing rules for digital assets | U.S.-based companies, proof of concept required | Up to 24 months |

| United States (Wyoming) | Wyoming Division of Banking | Explicit recognition of digital assets as property | Companies incorporated in Wyoming | Up to 24 months |

| European Union | European Commission + National Regulators | Legal guidance, no exemptions; focused on MiCA alignment | Legal entities registered in EEA for ≥6 months | 12-24 months |

| United Kingdom | Financial Conduct Authority (FCA) | Original sandbox model; broad fintech focus | Any UK-based fintech firm | 6-12 months |

| Abu Dhabi Global Market (ADGM) | ADGM RegLab | Customized supervision per startup risk profile | Companies registered in ADGM | 12 months |

Some programs, like Arizona’s, are designed to remove barriers. Others, like the EU’s, are designed to teach. The EU’s approach is especially smart: instead of letting companies bypass rules, it helps them build compliance into their product from day one. That’s why many experts say the EU model is more sustainable long-term.

What Makes a Sandbox Successful?

Not every sandbox works. Some fail because regulators don’t understand blockchain. Others fail because startups don’t know how to engage. Here’s what separates the winners:- Clear criteria: Successful programs have published rules for who can apply, what’s allowed, and how long testing lasts. No guessing.

- Regulator expertise: If the regulators don’t understand smart contracts or tokenomics, they can’t help. The EU sandbox includes blockchain specialists and academic advisors-this isn’t optional.

- Two-way learning: The best sandboxes treat participants as partners. Regulators learn from startups; startups learn from regulators. It’s not a top-down audit.

- Clear graduation path: If a company passes testing, they should know exactly how to transition to full compliance. No dead ends.

For example, ADGM’s RegLab doesn’t just approve applications. It assigns each startup a dedicated regulator who adjusts oversight based on real-time risk data. If a project grows, the rules evolve with it. That’s agile regulation.

The Real Impact: From Testing to Regulation

The biggest win isn’t just that startups get to test. It’s that regulators get to learn. The EU’s Blockchain Regulatory Sandbox didn’t just help companies-it helped shape MiCA, the continent’s first unified crypto law. Regulators used sandbox data to understand how DeFi protocols actually operate, how stablecoins behave under stress, and where existing rules fell apart. In the U.S., states like Arizona and Wyoming used sandbox feedback to draft laws that now define digital assets as property, not securities. That’s huge. It means crypto companies aren’t just surviving-they’re helping rewrite the rules. This isn’t theoretical. A 2024 report from the World Economic Forum found that jurisdictions with active sandboxes saw 3x more crypto innovation activity than those without. And startups that graduated from sandboxes were 50% more likely to remain compliant after launch.

Limitations and Risks

Sandboxes aren’t magic. They’re resource-heavy. Both regulators and startups need dedicated staff, legal teams, and time. Smaller firms often can’t afford the paperwork or the compliance monitoring. Some sandboxes have long waitlists-six months just to get reviewed. There’s also the risk of "sandbox capture," where regulators get too close to startups and lose objectivity. Or worse, companies treat sandboxes as loopholes and push boundaries too far. That’s why transparency and exit audits are critical. Successful programs require public reporting on outcomes: how many products launched, how many users were protected, what rules changed because of the test.What’s Next?

The future of crypto regulation isn’t about choosing between innovation and safety. It’s about blending them. Sandboxes are becoming permanent fixtures-not temporary experiments. The EU is already planning to expand its sandbox to include NFTs and tokenized real-world assets. The U.S. is seeing pressure for a federal-level sandbox, with bipartisan bills introduced in 2025. Cross-border coordination is the next frontier. Right now, a startup testing in the EU can’t easily move to Arizona. But as more countries adopt similar frameworks, harmonization will follow. Imagine a global sandbox network where a company can test in one jurisdiction and get automatic recognition in others. That’s the next step. For now, if you’re building in crypto, don’t wait for regulations to catch up. Find a sandbox. Apply. Test. Learn. And help shape the rules before they’re written in stone.What is a regulatory sandbox for crypto?

A regulatory sandbox for crypto is a supervised testing environment where blockchain and cryptocurrency companies can trial new products or services under relaxed rules, while regulators observe, collect data, and adjust regulations. It’s not a loophole-it’s a structured way to innovate safely.

Which U.S. states have crypto regulatory sandboxes?

As of 2026, eight U.S. states have active crypto or blockchain-focused sandboxes: Arizona, Florida, Hawaii, Nevada, North Carolina, Utah, West Virginia, and Wyoming. Arizona and Wyoming have the most developed programs, with explicit language around digital assets and blockchain technology.

Does the EU sandbox give companies legal exemptions?

No. Unlike some U.S. programs, the EU Blockchain Regulatory Sandbox does not grant exemptions from existing laws. Instead, it provides direct regulatory guidance and legal advice to help companies comply with MiCA, AML, KYC, and other rules while testing their products.

Can small startups join a crypto sandbox?

Yes, but it depends. Programs like the EU’s and ADGM’s are open to early-stage startups as long as they’re legally registered and have a working prototype. However, the application process can be complex and requires legal and technical documentation. Smaller teams often need legal support to navigate it.

Do regulatory sandboxes lead to real law changes?

Yes. The EU’s sandbox directly informed the creation of MiCA, the continent’s first comprehensive crypto regulation. U.S. states like Wyoming used sandbox feedback to pass laws recognizing digital assets as property. Sandboxes aren’t just testing grounds-they’re policy labs.

Comments

mahikshith reddy

Let me get this straight-you’re telling me regulators are now *teachers*? 🤡

They don’t get to play god with innovation and then pat themselves on the back for ‘guidance.’ This isn’t daycare. It’s capitalism. If you can’t figure out how to regulate crypto without hand-holding, maybe you shouldn’t be in charge.

And don’t act like the EU’s ‘no exemptions’ model is some noble moral victory. It’s just control dressed in a suit. They’re not helping-they’re locking you into their bureaucratic cage. Innovation dies in compliance theaters.

February 9, 2026 at 08:22

Udit Pandey

While I appreciate the theoretical framework presented here, I must respectfully contend that the very notion of regulatory sandboxes as instruments of innovation is fundamentally flawed. The state, by its nature, cannot be a partner in disruption-it is the inertia against which progress must struggle. To grant temporary reprieves from legal obligations is to institutionalize arbitrariness. True innovation thrives not under the watchful eye of bureaucrats, but in the unregulated void where risk and reward coexist without permission.

Furthermore, the suggestion that jurisdictions like Wyoming and the EU are ‘leading’ is misleading. They are not pioneers-they are bureaucrats adapting to pressure, not vision. The real innovators are the ones operating outside these systems entirely, quietly building the future while the regulators debate semantics.

February 10, 2026 at 14:23

Katie Haywood

lol so the EU’s sandbox is basically ‘we won’t let you break the rules, but we’ll help you learn them’? That’s cute.

Meanwhile, Arizona’s like ‘here’s a free pass, go wild (but don’t get caught)’. Honestly? I’d take Arizona. The EU’s version sounds like a corporate compliance webinar with extra steps.

Also-can we talk about how no one ever mentions the real winners? The devs who just deploy on Arbitrum and ignore all of this. 🤷♀️

February 11, 2026 at 18:43

Matt Smith

REGULATORY SANDBOXES?? 😂

Bro, this is just crypto’s version of ‘let’s play nice with the cops so they don’t raid our office’.

Meanwhile, the real builders are in DAOs with no HQ, no lawyers, and a VPN. They don’t need ‘guidance’-they need silence.

Also, MiCA? More like MiCAUSE. 😈

And don’t even get me started on ‘graduation paths’-you think they’ll let you graduate if your token pumps 5000%? Nah. They’ll shut you down for ‘market manipulation’ and call it a ‘lesson learned’. 🤡

February 12, 2026 at 10:00

orville matibag

As someone who’s lived in 3 countries and built crypto stuff in all of them, I can say this: sandboxes work if you’re not trying to be a startup. If you’re a solo dev with a GitHub repo and a Discord, you’re better off just launching and asking for forgiveness later.

But if you’ve got investors, lawyers, and a business plan? Then yeah, the EU sandbox is actually kinda solid. They don’t give you loopholes, but they give you a hotline to actual experts who’ve seen 200 DeFi projects fail.

Arizona’s cool if you want to be a ‘legal pioneer’. But if you want to survive? Go EU. Just don’t expect them to cheer you on. They’ll nod, take notes, and then change the rules next month.

February 14, 2026 at 01:44

Josh Flohre

Let’s be brutally honest: these so-called ‘sandboxes’ are PR stunts. The EU’s ‘guidance’ model is a facade. They don’t want innovation-they want control. They’re not ‘learning’ from startups-they’re weaponizing data to build tighter regulations.

And don’t even mention Wyoming. That’s not a regulatory framework-it’s a tax haven with blockchain branding. They don’t care about compliance. They care about attracting VC money with a shiny sticker.

Real innovation doesn’t need permission. It doesn’t need a permit. It doesn’t need a ‘graduation path’. It just happens. And the moment you ask regulators for a sandbox, you’ve already lost.

February 15, 2026 at 20:16

Brendan Conway

man i just wanna build something cool and not have to fill out 12 forms just to test it with 50 people

why does everything have to be a class? like bro, i just made a wallet that lets people send crypto without a phone number. why am i being told i need a ‘supervised environment’?

the regulators are just scared. they dont get it. and honestly? i dont blame them. i dont get it either. but i still wanna try.

can we just… let people try? without the ‘structured testing’? like… in a garage? with pizza? 😅

February 16, 2026 at 17:36