When you stake Ethereum, your ETH helps secure the network - but it also sits idle. You earn rewards, sure, but that same ETH can't be used anywhere else. That’s the problem restaking solves: it lets you use your staked tokens to secure multiple blockchains at once. No extra coins. No locking up more capital. Just the same ETH, working harder.

What’s Wrong With Traditional Staking?

In traditional staking, you lock up 32 ETH to become a validator on Ethereum. You earn around 3-5% annually. Sounds good - until you realize your ETH is frozen. You can’t lend it. You can’t use it as collateral. You can’t stake it again elsewhere. It’s locked in one place, doing one job. By mid-2024, over $30 billion in ETH was staked. But according to CryptoSlate, more than 65% of that staked ETH was completely unused beyond its original purpose. That’s $20 billion sitting still while the rest of DeFi is moving fast. This is the capital inefficiency problem - and it’s huge.How Restaking Changes the Game

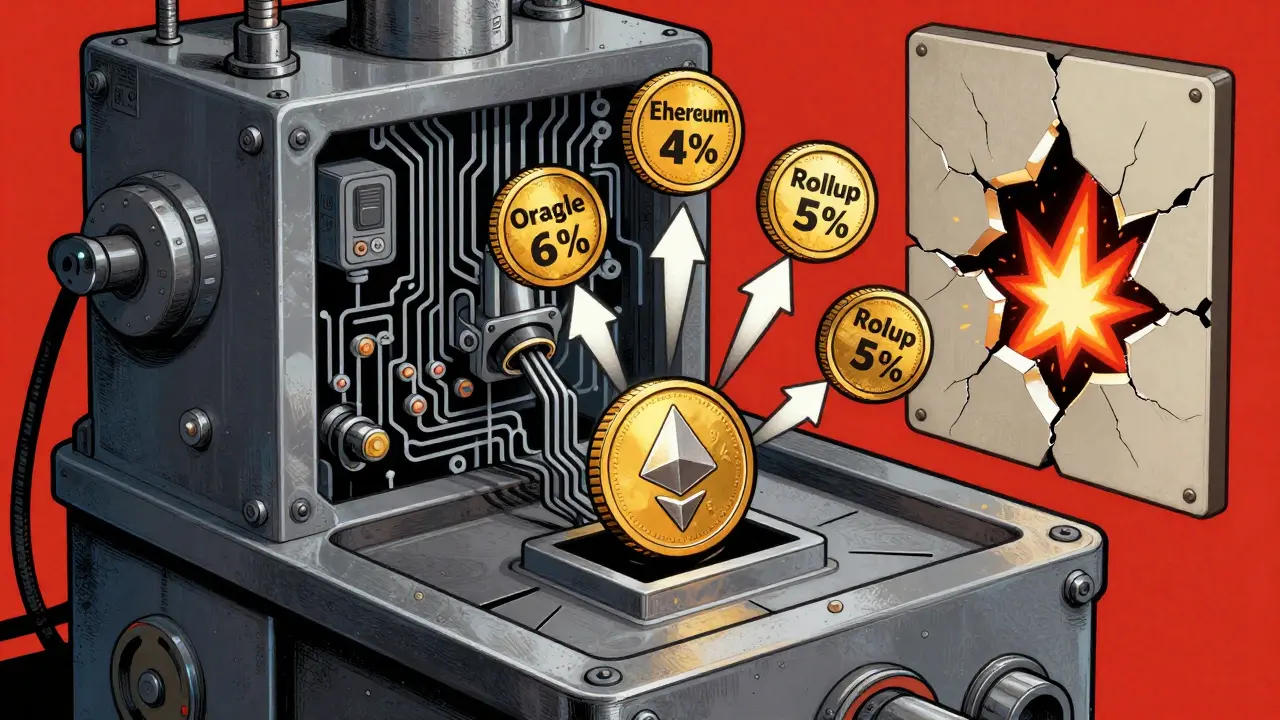

Restaking flips this. Instead of letting your staked ETH sit, you let it help secure other protocols too. Think of it like renting out your house not just to one tenant, but to five - all at the same time. You still own the house. You still get rent from each one. And you don’t need to buy five houses. The main player here is EigenLayer is a restaking protocol that allows Ethereum stakers to re-delegate their staked ETH to secure other blockchain services. Also known as EigenLayer Restaking, it launched its mainnet in October 2023 and now controls 87% of the $1.2 billion restaking market as of June 2024. Here’s how it works:- You stake ETH normally - either directly or through a liquid staking provider like Lido or Rocket Pool.

- You opt into EigenLayer’s restaking program.

- Your staked ETH now acts as security for other protocols - like decentralized oracle networks, rollups, or new Layer 2 chains.

- You earn your original Ethereum staking yield plus extra rewards from each protocol you help secure.

Why This Matters for Blockchains

Not all blockchains can afford to pay validators millions in token rewards. New rollups, sidechains, and privacy layers often lack the budget - or the user base - to bootstrap their own security. Restaking gives them a shortcut. Instead of issuing new tokens to attract validators, they can piggyback on Ethereum’s massive staked capital. Ethereum’s $30 billion security becomes a shared resource. This is called shared security. For example, a new zk-rollup might offer 6% APR to restakers who help verify its transactions. You, as a restaker, get that 6% on top of your 4% Ethereum yield. The rollup gets security without spending millions on token incentives. Everyone wins - if the system holds.

The Trade-Off: More Risk, More Complexity

Restaking isn’t free. You’re not just earning more - you’re taking on more risk. In traditional staking, if Ethereum has a glitch, you might lose rewards - but your ETH stays safe. In restaking, if one of the protocols you’re securing gets hacked or misbehaves, you can get slashed. That means part of your staked ETH gets burned as punishment. EigenSecurity’s February 2024 report found that restaking increases slashing risk by 3.2 times compared to native staking. Why? Because now you’re tied to multiple systems. A bug in a single oracle network could trigger a slashing event across dozens of restakers. There’s also the risk of correlated failures. If multiple protocols you’re securing go down at once - say, during a network-wide congestion event - your losses multiply. This happened in March 2024, when restaked assets briefly dropped 12% in value after a chain of failures. And it’s not just technical. Restaking requires serious setup. You need:- A Linux server with at least 4 cores, 16GB RAM, and 500GB SSD storage

- Knowledge of Ethereum’s consensus mechanics

- Ability to manage multiple middleware services

- Constant monitoring of slashing conditions across protocols

Who Is Restaking For?

Restaking isn’t for everyone. The minimum stake is still 32 ETH - roughly $100,000 at current prices. That puts it out of reach for most retail investors. According to Token Terminal, institutions now control 63% of all restaked value. Chainalysis data shows 89% of restakers have held crypto for over three years and have portfolios over $250,000. It’s a tool for sophisticated players: professional validators, crypto-native hedge funds, and institutional staking providers like Coinbase and Consensys. These groups have the resources to manage the risk, monitor the systems, and absorb potential losses. Retail users? Most are better off sticking with simple staking or liquid staking derivatives. The complexity and risk aren’t worth the extra yield unless you know exactly what you’re doing.

Regulatory Uncertainty and the Future

Governments are watching. The SEC flagged restaking in March 2024 as a potential regulatory blind spot. Gary Gensler called it a "novel risk vector" that blurs the line between staking and securities. The EU’s MiCA framework doesn’t even mention restaking. That’s a problem. If regulators decide restaking is a security, it could trigger legal headaches for protocols and users alike. But the tech is evolving. EigenLayer’s May 2024 upgrade introduced slashing insurance pools - reducing single-event losses by 35%. And Ethereum’s upcoming EIP-7251, scheduled for late 2025, could lower the minimum staking requirement from 32 ETH to just 1 ETH. That could open restaking to millions more. For now, though, restaking remains a high-stakes, high-reward niche. It’s not a passive income tool. It’s a financial engineering play - one that turns idle capital into multi-tasking infrastructure.Is Restaking Worth It?

If you’re a professional validator with deep technical knowledge, a large ETH position, and a tolerance for risk - yes. Restaking can boost your yield by 2-3x without locking up new capital. If you’re a retail investor who just wants to earn 5% on your ETH? Stick with native staking. The extra yield isn’t worth the complexity, the risk, or the sleepless nights monitoring slashing alerts. The real win isn’t just higher returns. It’s that restaking makes blockchain security more efficient. Instead of every new protocol needing its own staking economy, they can share Ethereum’s. That’s how modular blockchains scale. Restaking doesn’t solve everything. But for those who can handle it, it’s the most powerful capital efficiency tool crypto has ever seen.What is restaking in crypto?

Restaking is a process where users stake their cryptocurrency (like ETH) on one blockchain, then use that same staked position to secure additional protocols. Instead of letting staked assets sit idle, restaking lets them earn rewards from multiple networks at once - increasing capital efficiency.

How does restaking increase capital efficiency?

Restaking increases capital efficiency by allowing the same tokens to perform multiple security functions simultaneously. Instead of locking ETH in just one staking contract, restaking lets it secure Ethereum plus other blockchains (like rollups or oracles). This means you earn multiple yields without staking additional capital - turning idle assets into productive ones.

What is EigenLayer and how does it work?

EigenLayer is the leading restaking protocol built on Ethereum. It allows ETH stakers to opt in to "activesets" - security-consuming protocols like decentralized oracles or Layer 2 rollups. When you restake through EigenLayer, your staked ETH becomes collateral that helps secure these external chains, and you earn extra rewards in return. It’s the primary mechanism enabling shared security across the Ethereum ecosystem.

What are the risks of restaking?

Restaking increases slashing risk by 3.2x compared to native staking. If any protocol you’re securing fails or misbehaves, your staked ETH can be partially burned as punishment. There’s also risk of correlated failures - if multiple protocols crash at once, your losses compound. Technical complexity, regulatory uncertainty, and high minimum stakes (32 ETH) further limit accessibility and safety.

Can retail investors use restaking?

Technically yes, but practically, most retail investors shouldn’t. Restaking requires 32 ETH (over $100,000), advanced technical skills, constant monitoring, and tolerance for high risk. Over 89% of restakers have over $250,000 in crypto holdings and more than three years of experience. For most, the complexity and risk outweigh the yield gains.

What’s the difference between restaking and liquid staking?

Liquid staking (like stETH from Lido) lets you stake ETH and receive a token that represents your stake - which you can then use as collateral in DeFi. But that collateral is still based on a single staked position. Restaking goes further: it directly uses your staked ETH to secure multiple protocols at once, earning yield from each. Restaking achieves 90-100% capital efficiency; liquid staking only achieves about 60%.

Is restaking regulated?

No clear regulations exist yet. The U.S. SEC has flagged restaking as a regulatory gray area, and Gary Gensler called it a "novel risk vector." The EU’s MiCA framework doesn’t cover it at all. This uncertainty makes restaking risky for both users and protocols - and could lead to future legal or compliance hurdles.

How much can you earn from restaking?

Restaking typically combines Ethereum’s base yield (3-5%) with additional protocol rewards, bringing total APYs to 8-15%. Some users report yields as high as 18% by participating in high-reward activesets. However, these returns come with significantly higher risk than traditional staking.

Comments

Katie Haywood

So let me get this straight - I lock up $100k in ETH, learn how to run a Linux server like a sysadmin on espresso, and hope none of the 12 random protocols I’m securing get hacked… just to earn an extra 5%? 😅

Meanwhile, my cousin in Florida just staked his 5 ETH on Lido and is sipping margaritas while his wallet grows. I’m over here checking slashing alerts at 3am like I’m guarding Fort Knox.

Capital efficiency? More like ‘capital exhaustion with extra steps.’

February 4, 2026 at 00:53

Paul Jardetzky

Y’all are acting like restaking is some scary monster 😤

It’s just leverage - like using your house as collateral for a business loan. If you know what you’re doing, it’s POWERFUL.

I’ve been restaking since Oct ’23 and my APY’s been averaging 11.7% - that’s $11k/year on 100 ETH. No new coins, no extra risk if you pick clean activesets.

Stop fearing tech that’s making DeFi 10x more efficient. Learn it. Use it. Win. 💪

February 4, 2026 at 15:26

Paul Gariepy

Okay, I just want to say - I’m not a dev, I’m not a miner, I’m not even a ‘crypto bro’ - but I spent 87 hours last month setting up EigenLayer on my Ubuntu rig… and I’m not even mad.

Yes, it’s complicated. Yes, I had to fix three slashing warnings. Yes, I cried when my node went offline during the March congestion event.

But now? I’m earning 13.2% APY. I’ve got 36 ETH staked. I’m sleeping better than I did in 2021. If you’re scared of complexity, you’re not ready for Web3. This isn’t Robinhood. This is infrastructure. And infrastructure doesn’t come with a ‘click to earn’ button. It comes with sweat. And it’s worth it.

Also, if you’re using a GUI wallet to restake… you’re doing it wrong. Get a CLI. You’ll thank me later.

- Paul (who still misspells ‘EigenLayer’ as ‘Eigenvector’ every time)

February 5, 2026 at 12:29

Udit Pandey

It is a matter of profound concern that Western financial institutions are exploiting the Ethereum network to extract value from retail participants through opaque mechanisms such as restaking. In India, we understand the sanctity of capital and the moral responsibility of financial innovation. Restaking, as it stands, is not merely an engineering feat - it is a predatory structure designed to concentrate wealth among technocratic elites while masking systemic risk as ‘efficiency.’

When a single validator’s misconfiguration can slash the savings of thousands, we must ask: who truly benefits? Not the people. Not the community. But the venture capitalists in Silicon Valley who have already cashed out.

Let us not mistake complexity for progress. Let us not confuse yield with virtue. The future of finance must be inclusive - not exclusive to those who own servers, understand RPC endpoints, and can afford to lose $30,000 in a single slashing event.

India stands for ethical innovation. We do not glorify risk disguised as reward.

February 6, 2026 at 06:12

Sharon Lois

SEC already knows. They’re just waiting for the first $500M slash to make an example.

February 6, 2026 at 12:31