By 2025, governments aren’t just watching the crypto boom-they’re building their own version of it. CBDC development has exploded, with 134 countries, representing 98% of global GDP, actively working on digital currencies backed by their central banks. That’s not a trend. That’s a global shift. Meanwhile, private cryptocurrencies like Bitcoin and Ethereum still dominate headlines, but their real competition isn’t coming from Wall Street-it’s coming from the Federal Reserve, the European Central Bank, and the People’s Bank of China.

CBDCs Aren’t Crypto-But They’re Taking Crypto’s Best Features

Let’s clear this up first: a CBDC is not Bitcoin. It’s not decentralized. It’s not anonymous. It’s digital cash issued and controlled by your country’s central bank. Think of it like an app version of the dollar in your wallet-except every transaction is recorded, traceable, and subject to government rules.

But here’s the twist: CBDCs are copying what made private crypto popular. Instant settlement. 24/7 availability. Cross-border payments without intermediaries. The Bahamas launched the Sand Dollar in 2020, letting citizens pay for groceries with a smartphone app-no bank account needed. Nigeria’s eNaira did the same, reaching over 10 million users by 2025. Jamaica and Zimbabwe followed. These aren’t experiments anymore. They’re real alternatives to cash and traditional banking.

And unlike private crypto, CBDCs don’t need you to buy them on an exchange. They’re distributed through existing banks, post offices, or mobile money platforms. In India, the digital rupee works offline. In Japan, pilots are testing user interfaces so simple that even elderly citizens can use them. This isn’t tech for early adopters. This is tech for everyone.

Private Crypto’s Edge Is Disappearing

Private cryptocurrencies once promised freedom from banks, governments, and control. But that freedom has a cost: volatility, slow transactions, high fees, and regulatory uncertainty. Bitcoin takes 10 minutes to confirm. Ethereum takes 12. A CBDC? Under 1 second. And it’s settled in real time, no matter the country.

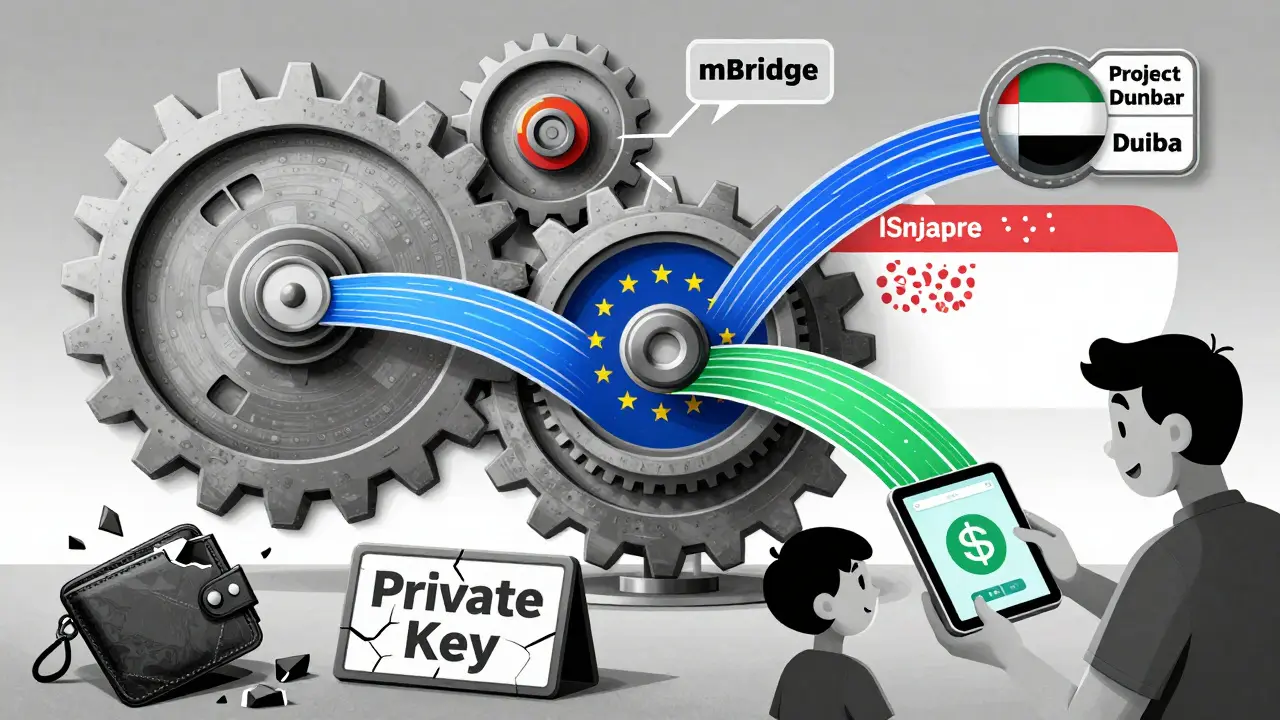

Cross-border payments are where the real battle is. In 2025, CBDCs processed $59 billion in international transactions-up 45% from the year before. Projects like mBridge (led by China, Hong Kong, Thailand, and the UAE) and Project Dunbar (Australia, Malaysia, Singapore, South Africa) are testing shared platforms that let banks in different countries settle payments instantly using digital central bank money. No correspondent banks. No currency conversion delays. No hidden fees.

Private crypto still moves money across borders, but it’s messy. You need to convert BTC to USDT, send it through a crypto exchange, then convert back to local currency. Each step adds risk, cost, and time. CBDCs cut that chain. And with 17 bilateral agreements already signed between nations to standardize CBDC rules, interoperability is no longer a dream-it’s happening.

Regulation Is the Secret Weapon of CBDCs

Private crypto thrives in gray areas. CBDCs thrive in clarity.

72% of central banks developing CBDCs say their top goal is cutting transaction costs and settlement times. But they’re also using the opportunity to fix what crypto can’t: compliance. 48% of CBDC projects have built AML and CFT (Anti-Money Laundering and Counter-Financing of Terrorism) rules directly into the system. That means if you try to move $100,000 in digital yuan from a known criminal network, the system flags it before the transaction completes.

Even privacy concerns are being addressed-not by removing oversight, but by designing it smartly. The Bank of Japan’s pilot includes a “privacy tier” system: small daily transactions (under $500) are anonymous, like cash. Larger ones require identity verification. That’s a compromise most people actually accept. In contrast, crypto wallets are often fully anonymous by design, making them magnets for illicit activity and drawing crackdowns from regulators worldwide.

And here’s what crypto can’t do: get legal tender status. A CBDC is money. You must accept it. You can’t refuse a digital dollar from the Fed any more than you can refuse a paper one. Private crypto? Still a commodity. Still optional. Still risky.

The Bank Run Problem: Why CBDCs Could Break the System

But CBDCs aren’t perfect. In fact, they might break the financial system they’re meant to fix.

Here’s the big fear: if people suddenly lose trust in their banks, they could rush to convert their savings into CBDCs. Why keep money in a bank that might fail when you can hold it directly with the central bank? That’s a bank run-but digital and instant.

The IMF warns this could drain banks of deposits, making it harder for them to lend money to homes, businesses, and startups. Interest rates could spike. Credit could freeze. That’s why countries like the U.S. and EU are designing CBDCs with limits: maybe you can only hold $5,000 in digital currency. Maybe it pays no interest. Maybe you can’t use it to pay for stocks or crypto.

Private crypto doesn’t have this problem. It doesn’t rely on banks. It doesn’t need government permission. But it also doesn’t have the backing of a central bank. If you lose your private key, your money is gone. Forever. If your CBDC wallet is hacked? The central bank can freeze it, trace it, and potentially restore your funds.

Security: CBDCs Are Safer-If Designed Right

Many assume crypto is more secure because it’s “decentralized.” That’s a myth.

Bitcoin’s blockchain is secure, yes-but exchanges get hacked. Wallets get stolen. Phishing scams target users daily. In 2024 alone, over $2.1 billion was stolen from crypto platforms.

CBDCs, by contrast, are built by central banks with decades of experience securing national financial systems. They use advanced encryption, multi-layered authentication, and real-time fraud detection. Over 100 central banks are using CBDC development as a chance to modernize their entire payment infrastructure. That means better security than most crypto apps, which are often built by startups with tiny teams and zero regulatory oversight.

That said, CBDCs create new risks. A single point of failure-a breach in the central bank’s system-could expose every citizen’s spending history. That’s why privacy-by-design and decentralized architecture elements (like zero-knowledge proofs) are being explored. But unlike crypto, where you’re on your own, CBDCs come with institutional backup: insurance, recovery options, and legal recourse.

The Real Winner? Coexistence, Not Conquest

CBDCs won’t kill Bitcoin. But they’ll make it irrelevant for most daily uses.

Private crypto still has value where governments can’t reach: censorship resistance, global access without borders, and trustless systems. Venezuelans use Bitcoin to bypass hyperinflation. Ukrainians use crypto to receive aid during war. Activists in authoritarian regimes use it to move money without surveillance.

But for the average person paying rent, buying groceries, or sending money to family abroad? CBDCs are faster, cheaper, safer, and legal. They’re built into the system you already use. No wallet setup. No exchange. No volatility.

The future isn’t CBDCs vs. crypto. It’s CBDCs for everyday money, and crypto for niche use cases-speculation, offshore holdings, or bypassing oppressive regimes. The real competition isn’t technology. It’s trust. Governments are betting their credibility on CBDCs. Crypto is betting on decentralization. One has the power of law. The other has the power of ideology.

By 2030, you’ll likely use both. But for most transactions? You’ll reach for the digital dollar, euro, or yuan-not the crypto app.

What’s Next?

Look for more CBDC pilots in 2026. The U.S. Federal Reserve is still in research mode, but the European Central Bank is preparing a digital euro rollout. India is expanding its digital rupee to rural areas. China is testing cross-border use with ASEAN nations.

Meanwhile, private crypto is shifting focus: from price speculation to real-world utility-DeFi lending, tokenized assets, and identity systems. But without government backing, it’s unlikely to replace money.

The digital currency race isn’t about who’s faster. It’s about who’s more reliable. And right now, the central banks are winning that race-by design, not by accident.

Are CBDCs the same as Bitcoin or Ethereum?

No. CBDCs are digital versions of national currencies like the dollar or euro, issued and controlled by central banks. Bitcoin and Ethereum are decentralized cryptocurrencies with no government backing. CBDCs are traceable, regulated, and legal tender. Crypto is anonymous, volatile, and not legal tender anywhere.

Can I use CBDCs to pay for things online?

Yes. CBDCs are designed for everyday use-online shopping, bill payments, peer-to-peer transfers. Countries like Nigeria and the Bahamas already let people pay for goods and services using their digital currencies via mobile apps. In the future, CBDCs will integrate directly with apps like Apple Pay, Google Pay, and online retailers.

Will CBDCs replace cash?

Not entirely. Most central banks plan to keep cash available, especially for elderly populations and those without smartphones. But CBDCs are meant to reduce reliance on cash, especially in urban areas. In countries with high smartphone adoption, cash use is already declining-CBDCs will speed that up.

Do CBDCs track my spending?

Yes, but with limits. CBDCs record transactions for compliance and security, but many designs include privacy tiers. Small transactions (under $500) may be anonymous, like cash. Larger ones require identity verification. The goal isn’t surveillance-it’s preventing fraud, money laundering, and terrorist financing.

Why aren’t more countries using CBDCs yet?

Building a CBDC is complex. It requires new infrastructure, legal frameworks, cybersecurity measures, and public trust. Many countries are still testing pilots. Only 4-11 have fully launched so far. The U.S. and EU are taking a cautious approach, prioritizing privacy and financial stability over speed.

Can CBDCs be hacked?

No system is unhackable, but CBDCs are built with far stronger security than most crypto platforms. Central banks use enterprise-grade encryption, multi-signature controls, and real-time monitoring. Unlike crypto exchanges, which are private companies, central banks have decades of experience securing national financial systems. If your CBDC wallet is compromised, you may be able to recover funds-unlike with crypto, where lost keys mean lost money.

Will CBDCs make crypto obsolete?

Not entirely. Crypto still has value in areas where governments can’t reach-like bypassing sanctions, avoiding censorship, or storing value in hyperinflationary economies. But for everyday payments, remittances, and government services, CBDCs are more practical. The future likely includes both: CBDCs for daily money, crypto for niche uses.

Comments

Rahul Sharma

CBDCs are a game-changer for countries like India where millions still rely on cash. The digital rupee pilot in rural areas? Pure magic. No more middlemen, no more delays. And yes, it works offline too! 🚀

January 12, 2026 at 22:27

Brittany Slick

I love how CBDCs feel like an upgrade, not a takeover. Like switching from dial-up to fiber-same goal, way smoother ride. 💙

January 13, 2026 at 13:56

greg greg

Let’s not ignore the structural implications here-central banks aren’t just digitizing currency, they’re redefining the social contract between citizen and state. Every transaction recorded, every spending pattern analyzed, every limit imposed under the banner of ‘financial stability.’ This isn’t progress-it’s institutional capture dressed in UX polish. The promise of efficiency masks a terrifying centralization of control, and we’re being sold this as a feature, not a flaw. We’ve traded anonymity for convenience without realizing we’re surrendering autonomy one microtransaction at a time.

January 15, 2026 at 00:38

Gideon Kavali

China’s digital yuan? That’s not innovation-that’s surveillance with a mobile app! And we’re supposed to cheer? The Fed better not touch this. America doesn’t need a digital leash. Cash is freedom-and if you want to take it away, you’ll have to pry it from my cold, dead hands! 🔫🇺🇸

January 15, 2026 at 14:29

Jordan Leon

There’s a quiet irony here: crypto promised liberation, but ended up being too chaotic for daily life. CBDCs offer order, but at the cost of autonomy. Neither is perfect. The real question isn’t which wins-it’s whether we’re willing to trade privacy for predictability. And if we are… who gets to decide that for us?

January 17, 2026 at 08:31

Meenakshi Singh

lol the 'privacy tier' is a joke. You think people don't know their $499 coffee purchase is still being logged? The moment you link it to your ID, anonymity is a fairy tale. CBDCs are just the state's version of Venmo with extra steps. 🤡

January 17, 2026 at 21:42

Sarbjit Nahl

You say CBDCs are safer than crypto but ignore that crypto’s security is user-controlled. Central banks have a 100% track record of never mismanaging money. Right. The system is already rigged. Why trust the same institution that crashed 2008 to now hold your digital life savings?

January 18, 2026 at 21:28

Allen Dometita

Look-CBDCs are the future, and fighting it is like yelling at the internet. But crypto? It’s still the rebel with a cause. Use CBDCs to pay rent. Use crypto to send money to your cousin in Venezuela. Both have their place. Stop the holy war. 🙌

January 19, 2026 at 13:19