When you're trading crypto, depth isn't just a buzzword-it’s what keeps your orders filled without slippage. A deep exchange means you can buy or sell large amounts without crashing the price. That’s critical whether you're moving $5,000 or $500,000. In 2026, not all exchanges are built the same. Some look flashy but freeze when volatility hits. Others have rock-solid liquidity but feel like a terminal from 2015. So which ones actually deliver depth-and why does it matter?

What Depth Really Means in a Crypto Exchange

Depth refers to the volume of buy and sell orders stacked at different price levels on the order book. High depth means there are large orders sitting just above and below the current price. If you want to buy 10 BTC, a deep exchange will fill it at a stable price because there’s enough supply nearby. A shallow one? You’ll end up paying 2% more because the system has to chase higher bids.

Think of it like a supermarket. If you walk in and there are 200 loaves of bread on the shelf, you grab one and leave. But if there are only three, and you need ten, you’re stuck waiting-or paying more. Crypto order books work the same way. Depth = stability. Depth = control.

Top 5 Exchanges for Depth in 2026

Based on trading volume, order book liquidity, and institutional adoption as of November 2025, here are the five exchanges that consistently deliver real depth:

- Kraken - 450+ cryptocurrencies, 800+ trading pairs, 98% of assets in cold storage

- Coinbase - 250+ assets, 112 million users, strongest US regulatory compliance

- Gemini - 73 assets, $321M insurance, NYDFS BitLicense holder

- Crypto.com - 200+ assets, best mobile app, Visa card integration

- Binance US - 158 assets, high volume but limited to 43 U.S. states

These aren’t just popular-they’re deep. Their order books have thick layers of buy and sell orders across major pairs like BTC/USD, ETH/USD, and SOL/USD. That’s why professional traders and institutions use them.

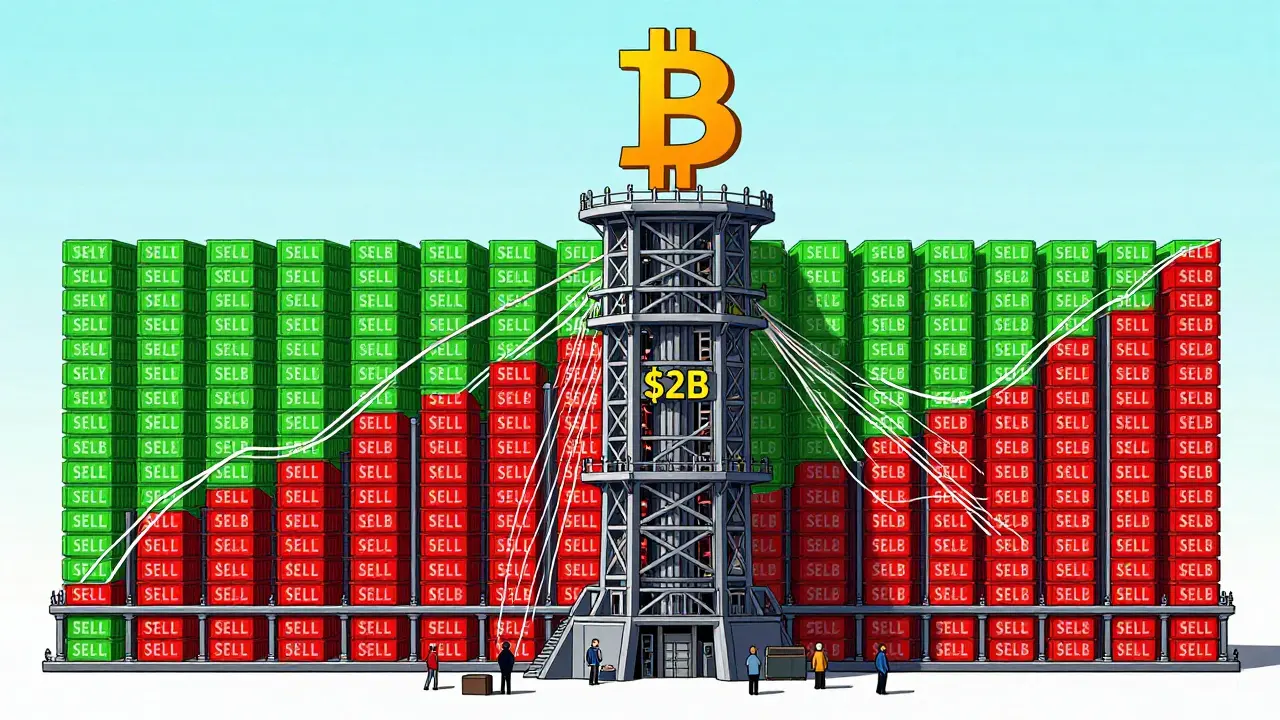

Kraken: The Depth King

Kraken leads in depth for one reason: it’s built for traders, not tourists. Its order book for BTC/USD regularly holds over $2 billion in total buy and sell volume within 1% of the current price. That’s more than most exchanges hold across all pairs.

Maker fees start at 0.00% if you trade over 50 BTC monthly. Even casual traders pay just 0.16%-far below Coinbase’s 0.50%. Kraken Pro’s API responds in under 100ms, making it the go-to for algorithmic traders. In November 2025, 78% of Reddit users in r/CryptoCurrency praised its order book depth during the October price swing, when Coinbase’s platform lagged.

But it’s not perfect. The sign-up and KYC process takes 2-5 days. If you want to trade fast, Kraken’s not the easiest. But if you want to trade smart? It’s unmatched.

Coinbase: The Beginner’s Gateway With Hidden Depth

Coinbase has the most users-112 million globally. That massive base creates natural depth. Even if you’re not trading large amounts, the sheer number of buyers and sellers means your small orders get filled quickly.

Its Advanced Trading platform supports limit orders, stop-losses, and trailing stops with clean charts. The mobile app is simple, reliable, and updated constantly. In November 2025, 82% of Trustpilot reviews highlighted its intuitive interface.

But here’s the catch: fees. Coinbase charges 0.50% for maker trades. That’s double Kraken’s lowest rate. And if you’re doing frequent trades, those fees add up fast. Their new $29.99/month Coinbase One plan removes trading fees, but it’s only worth it if you trade over $10,000 monthly.

Still, for beginners or those who want to buy Bitcoin and hold, Coinbase’s depth is real-and its security is industry-leading. It’s the most regulated exchange in the U.S., with full SEC compliance and $300M+ in insurance.

Gemini: Security First, Depth Second

Gemini doesn’t have the most coins or the highest volume. But it has something rarer: trust. As a New York State-licensed exchange, it’s held to stricter standards than almost any other U.S. platform.

Its order book for BTC/USD is thinner than Kraken’s, but still deep enough for most retail traders. What makes Gemini stand out is its transparency. It publishes weekly proof-of-reserves reports. Every dollar of user crypto is backed by real assets. That’s rare.

It supports only 73 cryptocurrencies-less than half of Kraken’s offering. If you want to trade lesser-known altcoins, skip Gemini. But if you’re focused on Bitcoin, Ethereum, and a few major tokens? Its depth is clean, reliable, and secure. Users report fewer slippage issues during spikes than on Robinhood or Uphold.

Crypto.com: Mobile Depth for Everyday Use

If you trade on your phone, Crypto.com is your best bet. With a 4.8/5 rating on the App Store from over 127,000 reviews, it’s the most polished mobile experience in the market.

Its order book depth isn’t as deep as Kraken’s for large trades, but it’s more than enough for retail users. The real win? The Visa card. You can spend crypto directly, earn cashback, and even earn interest-all in one app. That kind of integration creates liquidity because users aren’t just trading-they’re using crypto daily.

Downside? Customer support is slow. Trustpilot gives it 3.2/5 for support. And during major price moves, the app crashes for 15-30% of users. If you’re day trading volatile altcoins, keep a backup platform ready.

Binance US: Volume Without the Global Edge

Binance US offers 158 cryptocurrencies and high trading volume, but it’s a shadow of the global Binance platform. Due to U.S. regulations, it can’t offer futures, staking, or many DeFi features.

Still, its order book depth for BTC and ETH is solid. It’s the second most-used exchange in the U.S. after Coinbase. But it’s only available in 43 states. If you’re in New York or Hawaii, you can’t even sign up.

It’s a good choice if you want a wide selection of coins and low fees. But if you need reliability, regulatory clarity, or customer service? You’ll find better options.

What to Avoid: Shallow Exchanges

Not all exchanges are created equal. Some look tempting with zero fees or flashy ads-but their order books are paper-thin.

- Robinhood - Only 25 coins. Zero fees, but pays for order flow. That means your trades get routed to high-frequency firms that profit from your execution. SEC Chair Gary Gensler called this practice a hidden cost.

- Uphold - 24-hour customer support wait times. Trustpilot rating: 2.1/5. Order book depth is inconsistent.

- Fidelity Crypto - Only 25 assets. Great for institutional investors, but useless for anyone wanting to trade anything beyond Bitcoin and Ethereum.

These platforms are fine for casual users who just want to buy Bitcoin and forget it. But if you care about price accuracy, fast fills, or trading during volatility? Avoid them.

How to Test Depth Before You Trade

You don’t need to be a pro to check depth. Here’s how:

- Go to any major exchange’s trading page (Kraken, Coinbase, etc.)

- Look at the order book on the left side of the screen. You’ll see two columns: bids (buyers) and asks (sellers).

- Count how many orders are stacked within 1% of the current price. If you see $100M+ in combined bids and asks? That’s deep.

- Try placing a small limit order-say, $500 worth of BTC-just below the current price. If it fills instantly, the depth is good.

- Check the 24-hour trading volume. If it’s under $50M for BTC/USD, the exchange is too shallow for serious trading.

Pro tip: Use CoinGecko or CoinMarketCap to compare order book depth across exchanges. They show real-time liquidity heatmaps.

Future of Depth: What’s Coming in 2026

Exchanges are evolving fast. Kraken just launched Krak-a P2P payment app that lets users send crypto instantly, for free. That’s increasing liquidity by turning users into active participants, not just traders.

Coinbase is preparing to list tokenized real-world assets like bonds and real estate in Q1 2026. That will add massive new depth to its order books.

Meanwhile, MiCA regulations in Europe and the U.S. Digital Commodities Act are forcing exchanges to prove they hold user funds. That means fewer fly-by-night platforms. The market is cleaning up.

By 2027, experts predict the number of active exchanges will drop by 25%. Only the deepest, most secure, and most regulated will survive.

Final Verdict: Who Should Use What?

Here’s who wins where:

- Professional traders → Kraken (best depth, lowest fees, fastest API)

- Beginners → Coinbase (simple, secure, reliable)

- Security-focused users → Gemini (transparency, insurance, compliance)

- Mobile-only traders → Crypto.com (best app, card integration)

- Altcoin hunters → Kraken or Binance US (most coins)

- Anyone wanting zero fees → Coinbase One ($29.99/month, only if you trade over $10K/month)

Depth isn’t glamorous. But it’s the difference between a smooth trade and a costly mistake. In 2026, don’t pick an exchange because it’s popular. Pick it because its order book can handle your trades-no matter how big or fast they are.

What does depth mean in a crypto exchange?

Depth refers to the volume of buy and sell orders stacked at different price levels on an exchange’s order book. High depth means there are large orders close to the current price, allowing you to buy or sell larger amounts without drastically moving the market. It’s what prevents slippage and ensures your trades execute at predictable prices.

Which crypto exchange has the deepest order book in 2026?

Kraken has the deepest order book among major exchanges as of 2026. It supports over 800 trading pairs and holds over $2 billion in combined buy and sell orders for BTC/USD within 1% of the current price. Its institutional-grade infrastructure and low fees attract high-volume traders, making it the most liquid platform for serious trading.

Is Coinbase good for depth trading?

Yes, but with caveats. Coinbase has high overall trading volume thanks to its 112 million users, which creates solid depth for major pairs like BTC/USD and ETH/USD. However, its fees are higher than Kraken’s, and its Advanced Trading platform isn’t as fast or customizable. It’s great for beginners and moderate traders but not ideal for high-frequency or large-volume traders who need ultra-low latency and fees.

How do I check if an exchange has good depth?

Go to the trading page and look at the order book. Check how much volume is stacked within 1% of the current price. If the combined buy and sell orders total $50 million or more for BTC/USD, it’s deep enough for most traders. Also, check the 24-hour trading volume on CoinGecko-anything under $50 million suggests shallow liquidity. Try placing a small limit order just below the current price-if it fills instantly, the depth is good.

Why do some exchanges have shallow order books?

Shallow order books happen when an exchange has low user volume, limited asset selection, or poor liquidity provision. Platforms like Robinhood and Uphold attract users with zero fees or flashy features but don’t incentivize large institutional orders. They also often lack API access and deep market-making partnerships. Without big players placing large bids and asks, the order book stays thin, leading to slippage and poor execution during volatility.

Can I trade large amounts on any crypto exchange?

No. Only exchanges with deep order books-like Kraken, Coinbase, and Binance US-can handle large trades without significant price impact. If you try to buy $100,000 worth of Ethereum on a shallow exchange, you might end up paying 5-10% more than the market price. Always check the order book depth before placing large orders. For trades over $50,000, use institutional-grade platforms or request a custom quote from the exchange’s trading desk.

Comments

Antonio Snoddy

you ever just stare at an order book like it's a cosmic tapestry and wonder if we're all just ants on a sugar cube of market manipulation? Kraken's depth isn't just liquidity-it's a meditation on trust in a world where every bid is a whispered prayer and every ask a silent scream into the void. i've watched BTC/USD order books during the october swing like a monk watching fire-calm, detached, yet utterly consumed. the $2 billion within 1%? that's not data, that's soul. and yet... we still click buy when the red hits. we always do. 🤔

January 3, 2026 at 11:05

Jacky Baltes

I appreciate the breakdown, but I think we're missing a key point: depth isn't just about volume-it's about resilience. Exchanges like Gemini might not have the highest numbers, but their transparency and consistent reserves mean you can trust that the depth is real, not just artificially inflated by market makers. In a world where trust is the rarest asset, that matters more than raw numbers. No emojis needed.

January 5, 2026 at 08:44

Willis Shane

Let me be perfectly clear: if you're trading on anything other than Kraken, you're leaving money on the table and exposing yourself to systemic risk. Coinbase's 0.50% fee is a tax on incompetence. Crypto.com's app crashes during volatility? That's not a feature-it's a betrayal. And Binance US? Half a platform. You're not a trader if you're not using Kraken Pro. The API latency is under 100ms. Your latency is 300ms. You're not trading-you're guessing. Stop pretending.

January 7, 2026 at 02:27

Emily L

i just wanna buy btc and not die on a 30 second loading screen lmao why do yall make this so complicated??

January 8, 2026 at 14:55

Gavin Hill

Depth is just the visible part of the iceberg the real structure is the trust behind it the regulators the reserves the transparency none of that shows up on the chart but it's what keeps you from waking up to a 20% gap down because someone pulled the rug

January 9, 2026 at 06:09

Josh Seeto

Wow, so Kraken is the only exchange that doesn't suck? And Coinbase is just for people who need a babysitter? Cute. You know what else has deep order books? The dark pools that no retail trader can access. You're preaching to the choir while ignoring the real game. The real depth isn't on Kraken-it's in the institutional shadows where your trades get sliced, diced, and sold to HFTs before you even hit enter. You're not a trader. You're bait.

January 11, 2026 at 02:30

Adam Hull

Let’s be honest-this whole post is a glorified Kraken affiliate ad wrapped in pseudo-academic jargon. Depth? Please. The entire crypto market is a liquidity theater. The order books you’re praising? They’re populated by bots with 0.001% slippage tolerance and 300ms latency advantages. The ‘$2 billion in bids’? Half of it is ghost liquidity-phantom orders that vanish the second you try to execute. And don’t get me started on Gemini’s ‘transparency’-they publish reserves weekly, but they don’t disclose who’s backing them. You think that’s trust? It’s PR. The only thing that matters is who controls the order flow, and it sure as hell isn’t you or me. This isn’t trading. It’s performance art for the credulous.

January 12, 2026 at 22:59

Mandy McDonald Hodge

omg i just tried to buy 500$ of eth on coinbase and it took 4 mins to confirm and i swear my heart stopped i was so scared lmao i switched to crypto.com after and now i just use my card to buy coffee with btc and its so chill?? like why are we all overcomplicating this?? i just want to use my crypto not become a wall street analyst 😭❤️

January 13, 2026 at 03:42